World Insurance in 2015

No 3 /2016 World insurance in 2015: 01 Executive summary 03 The global economy and steady growth amid inancial marets in 201 regional disparities 0 nsurance premium growth steady 16 lobal trade and insurance maret growth 22 dvanced maret premiums grow aster than € 2 Emerging marets continue to gain global share 3 ‚ethodology and data 3ƒ „tatistical appendix

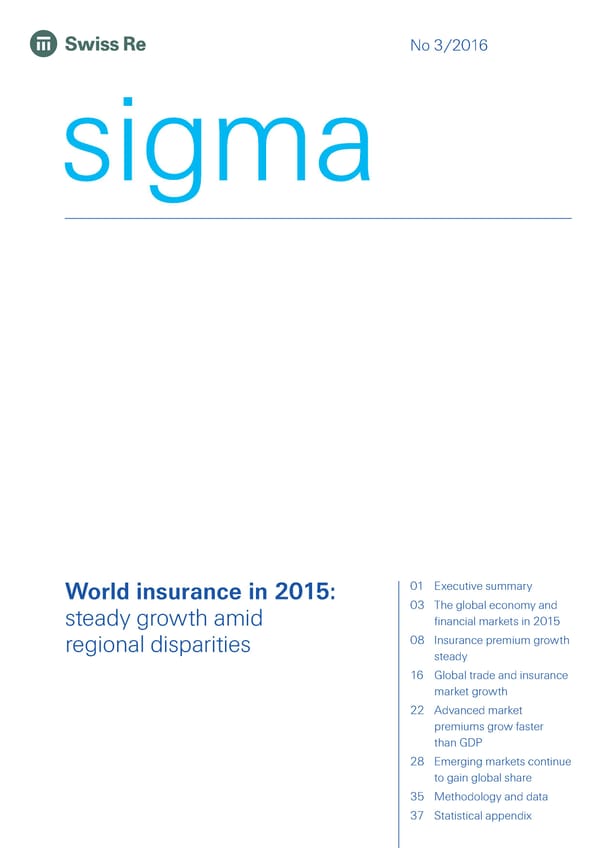

Executive summary The insurance industry aced another The re/insurance industry aced another year o moderate global economic growth 1 challenging year in 201‰ with moderate in 201… lobal real gross domestic product †€‡ grew by 2…ˆ… The advanced economic growth and low interest rates… economies improved‰ but there was slowdown in the emerging marets with many maŠor countries impacted by political instability and low commodity prices… The investment environment remained challenging globally‰ with uncertainty around policy tightening in the ‹„ and very low interest rates prevailing in advanced economies or another year… Œith the exception o some emerging marets‰ inlation was low in most countries‰ driven by the low commodity prices… lobal lie insurance premium growth espite the challenging environment‰ real global direct lie and nonŽlie insurance premiums written grew by 3…ˆ in 201‰ up rom 3…ˆ in the previous year…2 remained steady in 201‰ but the trend varied across regions… ‘owever‰ in nominal ‹„ dollar terms‰ premiums were down by ’…2ˆ due to wideŽ spread currency depreciation against the ‹„… n real terms‰ lie premium growth slowed to ’ˆ rom a ’…3ˆŽgain in 201’ †201“ ‹„ 2 3’ billion‡… n advanced marets lie premiums grew 2…ˆ‰ down rom 3…ˆ growth the previous year… North merica returned to positive growth ater two years o decline… ”ie premium growth was also stronger in advanced sia‰ driven by •apan and –orea… n Œestern Europe‰ however‰ growth slowed signiicantly… n the emerging marets‰ overall lie premium growth almost doubled to near 12ˆ‰ supported by strong sector perormance in emerging sia… rowth also improved in ”atin merica but was slower in the ‚iddle East and —entral sia‰ and rica… n —entral and Eastern Europe †—EE‡‰ premiums contracted… ”ast year‰ lie premium growth ell short o the preŽcrisis3 average in advanced marets yet again‰ but it was slightly higher in the emerging marets… Figure 1 Life Non-life Total lobal real premium growth rates‰ 201 dvanced marets 2…ˆ 2…6ˆ 2…ˆ Emerging marets 12ˆ ƒ…ˆ ¡…ˆ World 4.0 . . No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… 1 The aggregation o the individual economies that mae up the global economy is weighted using ‹„ dollar € based on maret exchange rates… nternational statistics using purchasingŽpower parity place more weight on astŽgrowing countries lie —hina and ndia and so show higher world € growth rates… 2 ‹nless otherwise stated‰ all premium growth rates indicate changes in real terms †ie‰ adŠusted or local consumer price inlation‡… 3 €reŽcrisis“ 2003–200ƒŸ postŽcrisis“ 200¡–201’… Swiss Re sigma No 3/2016 1

Executive summary Non-life premium growth improved in Global non-life premium growth improved to 3.6% in 2015 from 2.% the previou 2015… mainl driven b the advanƒed ear 2015 2 020 billion €. ‚he advanƒed mar„et were the main driver… with mar„et. all region other than †ƒeania e‡perienƒing higher growth rate. ˆdvanƒed ˆia ‰.1%€ regitered the highet growth among the advanƒed region… and there wa a ƒoniderable gain in North ˆmeriƒa ‰3.2%€ alo. Growth wa moderate in Šetern ‹urope ‰1.5%€… but that wa neverthele an improvement on previou ear of tagnation. ‹merging mar„et ƒontinued their robut premium growth trend ‰Œ.Ž%€… primaril driven b ‘hina. †ther mar„et in emerging ˆia were olid alo… a were the ’iddle ‹at and ‘entral ˆia ‰“.0%€. ”n ‘‹‹… non-life premium ƒontraƒted… due to a harp fall in •uia. –rofitabilit wa under preure in both –rofitabilit in life and non-life remained under preure in 2015. ”n life… moderate life and non-life… but both eƒtor are well premium growth in man mar„et and the prolonged low interet rate dragged on ƒapitalied. profit. ”n non-life… both the underwriting and invetment reult wa wea„er than in 201. ‚he underwriting reult wa impaƒted b lower reerve releae and invetment reult were hit b low interet rate. —owever… the inuranƒe indutr overall remain well ƒapitalied. ˜ife premium growth in the advanƒed ˜ife premium growth i e‡peƒted to aƒƒelerate lightl in the advanƒed eƒonomie mar„et will improve lightl… but non-life in 2016… mainl driven b a modet improvement in Šetern ‹urope and a reƒover premium growth will moderate. in †ƒeania. ”n the emerging mar„et… the life eƒtor i foreƒat to deƒelerate inƒe premium growth in ‘hina i e‡peƒted to low from the high level of 2015. ‚he out- loo„ for the non-life indutr in advanƒed mar„et i more muted than for life… given e‡peƒtation of a moderate eƒonomiƒ reƒover and priƒing wea„ne. ‚he outloo„ for non-life in the emerging mar„et i mi‡ed. –remium growth will li„el be trong in emerging ˆia… mainl upported b ‘hina. ”n other emerging region… however… premium growth i e‡peƒted to wea„en or even ƒontraƒt. ‚he peƒial ƒhapter of thi sigma foƒue ‚rade flow have lowed in reƒent ear. Global trade grew about twiƒe a fat a on lower trade growth and it world G– between the earl 1““0 and mid-2000… but ha grown at the ame impliƒation for related line of inuranƒe. paƒe a G– in more reƒent ear. ‚he lowdown ha in part been ƒƒliƒal due to luggih eƒonomiƒ growth… and trade hould piƒ„ up again onƒe eƒonomiƒ aƒtivit aƒƒelerate. —owever… the lowdown alo refleƒt deeper… truƒtural faƒtor… uƒh a a limit in the further diperion of global uppl ƒhain… proteƒtionim and the tranitioning of the ‘hinee eƒonom from e‡port- and invetment-led growth to dometiƒ erviƒe and ƒonumption. ‚he negative impaƒt of the trade lowdown on global growth reduƒe eƒtor-wide premium growth generall. ˆ peritent lowdown in global trade will affeƒt marine and ƒredit inuranƒe growth in partiƒular. ‚he data in thi tud are the latet ‚hi sigma tud ƒontain the latet mar„et data available at the time of going to available at the time of going to pre. pre. ‚he final figure for 2015 are not available for mot inuranƒe mar„et. ˆ uƒh… the sigma alo ƒontain wi •e ‹ƒonomiƒ •eearƒh ™ ‘onulting etimate and proviional data releaed b upervior authoritie and inuranƒe aoƒiation. 2 Swiss Re sigma No 3/2016

The global economy and inancial marets in 201 lobal economic growth uneven across regions The global economy grew moderately in The global re/insurance industry aced another year o moderate economic growth 201… in 201… lobal real gross domestic product †€‡ was up 2…ˆ‰ above the postŽ crisis annual average o 2…2ˆ… rowth in advanced marets continued to improve‰ to 1…¡ˆ rom 1…ˆ in 201’… This was still below the preŽcrisis but exceeded the postŽ crisis average by 1 percentage point †ppt‡… Emerging marets’ aggregate growth was disappointing at 3…ˆ‰ less than hal the preŽinancial crisis average growth levels o ƒ…’ˆ‰ and below the postŽcrisis average o ’…ƒˆ… rowth in the advanced marets mong the advanced marets‰ the ‹„ economy expanded by 2…’ˆ‰ while growth continued to improve slightly … in —anada ell to 1…2ˆ rom 2…ˆ in 201’… Total € growth in North merica ell to 2…3ˆ‰ slightly short o the preŽcrisis but 1 ppt more than the postŽcrisis annual average growth rate… •apan’s economy grew slightly ater a shallow recession in 201’… n Œestern Europe‰ growth improved to 1…ˆ in 201 †201’“ 1…’ˆ‡‰ supported by low interest rates‰ low oil prices and a relatively wea euro… The ‹– outperormed its continental peers again while within the Euro area‰ ermany and „pain grew aster than ¥rance and taly‰ where structural reorms are still much needed… … but emerging maret growth was ggregate emerging maret growth was wea at 3…ˆ‰ with some countries wea‰ with some countries impacted by struggling with low commodity prices and political instability… rowth in other low commodity prices and political marets‰ however‰ most notably —hina‰ —EE E‹ member countries and rican instability… nonŽcommodity exporters‰ remained solid… eep recessions in ¦ra§il and ¨ene§uela dragged on overall perormance in ”atin merica… ¦ra§il’s economy contracted by 3…ˆ‰ suering rom low commodity prices‰ high inlation and political uncertainty… n ‚exico‰ industrial activity was low while private consumption remained healthy… Economic growth in most —EE countries was solid but recession in ˜ussia †€ ell 3…ƒˆ‡‰ due to low oil prices and sanctions because o the ‹raine conlict‰ weighed on the region’s aggregate growth †–1…2ˆ‡… ndia overtoo —hina as the world’s The emerging sian economies expanded unevenly last year… —hina’s economy astest growing large economy… continued its transition rom manuacturing to services‰ and growth slowed to 6…¡ˆ‰ Šust below the government’s target o ƒˆ… ndia was the world’s astestŽexpanding large economy †£ƒ…3ˆ‡ in 201‰ with business and consumer sentiment improving signiicantly on expectations o a strong push towards economic reorm and liberali§ation by the Narendra ‚odi government… ‚aŠor economies in rica developed ‚aŠor economies in rica developed unevenly‰ driven largely by political unevenly due to political uncertainties developments and lower oil and commodity prices… rowth in „outh rica was and dependency on commodities… sluggish with companies there having to contend with lower commodity prices‰ wea domestic demand‰ electrical outages‰ worer stries and rising input costs… Nigeria and ngola suered rom low oil prices and inrastructure bottlenecs‰ while many oilŽimporting countries grew solidly †eg‰ ‚orocco‰ –enya and —ôte d’voire‡… n the ‚iddle East and —entral sia‰ „audi rabia experienced solid growth‰ supported by greater public spending‰ despite collapsing government revenues rom oil… rowth in Turey was robust‰ despite civil disturbance and political turmoil… Swiss Re sigma No 3/2016 3

T‚e gloƒal econo€ and financial ar„ets in 2015 Figure 2 rld ˜eal € growth by region in 201‰ and preŽ and postŽinancial crisis average Adanced markets rth America estern Ere Adanced Asia ceania Emerging markets Emerging markets excl. China Emerging Asia Emerging Asia excl. China Latin America and the Caribbean Central and Eastern Ere Middle East and Central Asia Aˆrica –2% 0% 2% 4% 6% 8% 10% †r‚th rate 201‡ re€crisis aerage gr‚th 200„–200… st€crisis aerage gr‚th 200ƒ–2014 ˜emars“ —ountries’ € weighted with maret exchange rates… „ource“ ¢xord Economics‰ ŒŒ‰ „wiss ˜e Economic ˜esearch ™ —onsulting… nterest rates and headline inlation approach §ero The E—¦ continued «uantitative easing‰ —entral ban intervention‰ policy divergence and uncertainty drove the inancial but the ‹„ ¥ed raised rates once… marets in 201‰ and interest rates were at record lows… The European —entral ¦an †E—¦‡ and the ¦an o •apan †¦o•‡ continued their expansionary and unconventional monetary policies as the Euro area and •apanese economies remained ragile with delation an ongoing ris… n contrast‰ the ‹„ ¥ederal ˜eserve ¦oard made a small move towards monetary policy normalisation with an interest rate hie in ecember… Figure 6.0% ”ongŽterm interest rates‰ ecember 200 to pril 2016 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% –1.0% Dec 2005Apr 2006Aug 2006Dec 2006Apr 2007Aug 2007Dec 2007Apr 2008Aug 2008Dec 2008Apr 2009Aug 2009Dec 2009Apr 2010Aug 2010Dec 2010Apr 2011Aug 2011Dec 2011Apr 2012Aug 2012Dec 2012Apr 2013Aug 2013Dec 2013Apr 2014Aug 2014Dec 2014Apr 2015Aug 2015Dec 2015Apr 2016 US Japan Germany U France „ource“ atastream… ’ Swiss Re sigma No 3/2016

n the emerging marets‰ policy rates nticipation o a ‹„ interest rate hie ept yields on ‹„ and ‹– 10Žyear government diverged… bonds about 1… ppt above the erman and •apanese e«uivalents †¥igure 3‡… The ‹„ too a irst step to monetary policy normalisation in 201‰ but interest rates in the advanced economies remain historically low †see ¦ox“ ”ow interest rates orever¬‡… Even so‰ inlation in the ‹„‰ the Euro area and the ‹– dropped close to §ero last year‰ based largely on low commodity prices… n the ‹„‰ core inlation‰ which excludes ood and energy‰ was essentially unchanged at 1…ˆ… nlation in •apan ell below 1ˆ ater rising to 2…¡ˆ in 201’ due to the sales tax increase in pril 201’… —risisŽhit ¦ra§il and ˜ussia increased policy rates in an attempt to counter capital outlows and inlation… n contrast‰ —hina and ndia both reduced their policy rates… t was a mixed year or stocs in the „toc maret perormance in advanced marets was mixed… The „™€ 00 in the ‹„ advanced marets… was down 0…ƒˆ‰ and the ‚„— ‹– index was down …¡ˆ… ¦y contrast‰ the •apanese Niei 22 was up ¡…1ˆ and the erman ® 30 by ¡…6ˆ †¥igure ’‡… The mixed perormance relects the diverging paths o monetary policy… ter three consecutive years o ending in positive territory‰ the world’s maŠor e«uity marets slowed due to increased uncertainty‰ wea proit growth and investor caution… Figure 4 10 „toc maret perormance‰ 201’–2016 †ecember 201’ ¯ 100‡ 1ƒ0 110 100 90 Ž0 70 an ƒ01‡„e… ƒ01‡Mar ƒ01‡€r ƒ01‡Ma ƒ01‡‹n ƒ01‡‹Œ ƒ01‡‹g ƒ01‡Se€ ƒ01‡Š†t ƒ01‡‚ˆ‰ ƒ01‡e† ƒ01‡an ƒ015„e… ƒ015Mar ƒ015€r ƒ015Ma ƒ015‹n ƒ015‹Œ ƒ015‹g ƒ015Se€ ƒ015Š†t ƒ015‚ˆ‰ ƒ015e† ƒ015an ƒ01 „e… ƒ01 Mar ƒ01 €r ƒ01 Ma ƒ01 US (S&P 500): –0.7% a€an (‚ikkei ƒƒ5): 9.1% MSCI UK: –5.9% erman ( 0): 9. % MSCI Emerging Markets: –17% Note“ percent values indicate yearŽonŽyear change o respective indices in 201… „ource“ atastream… Emerging maret stoc indices ell „toc marets in the emerging marets suered substantial losses driven by alling substantially… commodity prices‰ heightened political instability in many regions and uncertainty around ‹„ monetary policy… The ‚„— Emerging ‚arets index ell by 1ƒˆ in 201‰ but recovered partially in the irst «uarter o 2016… Swiss Re sigma No 3/2016

T‚e gloƒal econo€ and financial ar„ets in 2015 ¢utloo“ improving‰ but interest rates to rise only moderately There will liely be heightened maret The global economy aces our maŠor headwinds that will produce periods o maret volatility alongside moderate global volatility alongside moderate growth in 2016 and 201ƒ“ the ‹„ ¥ederal ˜eserve growth in the next two years… will continue to raise interest ratesŸ —hina continues to open its capital accountŸ commodity prices have stabili§ed at low levels and are unliely to increase substantiallyŸ and global political developments continue to create uncertainty… Nevertheless‰ in advanced marets economic undamentals remain strong… n the ‹„‰ real € is expected to continue to grow steadily this year and next‰ and employment and income growth are expected to remain strong… The Euro area is beneiting rom a wea euro and low oil prices‰ and growth is orecast to improve in each o the next two years… „table growth is liely in the ‹–‰ where consumer spending and housing construction have sustained momentum in the irst hal o 2016‰ in spite o the uncertainty created by the ¦rexit reerendum which has ’ dampened business investment and hiring… Economic growth in the emerging Economic growth in emerging marets is orecast to improve in 2016‰ relecting marets is orecast to pic up‰ but reduced recessionary pressures in ey marets in ”atin merica and —EE… ‘owever‰ challenges remain… wea growth in trade is liely to continue and inancial volatility‰ currency depreciation and capital outlows will remain ey challenges or many emerging economies… rowth in —hina is expected to slow in 2016‰ while ¦ra§il and ˜ussia will liely remain stuc in recession… n ¦ra§il challenges to governability will remain ollowing the recent impeachment o €resident ˜ousse‰ given the heavily charged and polari§ed political atmosphere… n ˜ussia low oil prices and the continuation o sanctions are holding bac growth… ˜is o an emerging maret inancial crisis continues‰ as indicated by wide emerging maret bond spreads… ‘owever‰ the threat o contagion is limited due to stronger inancial buers in individual marets and also enorcement o precautionary macroŽprudential measures… ‚onetary policy divergence will lobal monetary policy divergence will continue in 2016 ater the ¦o• surprised continue‰ and inlation is expected to marets with negative interest rates in •anuary and the E—¦‰ in ‚arch‰ announced accelerate‰ particularly in the ‹„… urther extension o its unconventional policy measures… nlation in the ‹„ is orecast to rise‰ and the ¥ed is expected to raise its policy rate two times in 2016… The slow pace o monetary tightening has increased the ris o inlation… The ¦an o England †¦oE‡ will liely ollow suit‰ with two rate hies starting in ugust ater the ¦rexit reerendum… n contrast‰ the E—¦ and ¦o• are more liely to ease monetary policy urther… n such an environment‰ yields on the ‹„ and ‹– 10Žyear government bonds are liely to rise modestly‰ to 2…2ˆ and 2…0ˆ‰ respectively‰ by endŽ2016… erman and •apanese 10Žyear yields will also rise‰ but by less †to 0…ˆ and 0ˆ‡… Their low value is essentially pulling down ‹„ and ‹– yields… volatility subsides‰ e«uity marets could improve and credit spreads could narrow urther this year… The global economy will liely muddle ‚any downside riss to the global economy remain… n the ‹„‰ the ris is inlation through in 2016‰ but downside riss ollowed by moreŽrapidŽthanŽexpected monetary tightening… n the Euro area‰ a remain… “rexit” could become a problem again as implementation o reorms is lagging… ‘owever‰ contagion ris has declined over the last ew years and the E—¦ has become a credible lender o last resort… mmigration will remain an issue in Europe and could compromise proŽreorm governments and/or delay implementation o structural reorms… n —hina economic and inancial riss remain high… The country is pursuing contradictory policies as it attempts to simultaneously liberalise its capital account‰ lower interest rates to support growth and maintain a stable exchange rate… string o unavourable events‰ such as deaults by property developers or local governments‰ or a sharp renminbi depreciation and capital outlows‰ would increase the lielihood o a hardŽlanding… 4 The result o the 23 •une 2016 vote in the ‹– on whether to stay in the E‹ was not nown at the time o going to print… 6 Swiss Re sigma No 3/2016

Low interest rates fore er… nterest rates remain very low ater the ter the inancial crisis‰ maŠor central bans ept policy rates at close to §ero or inancial crisis… about seven years to support economic recovery and put upward pressure on prices… n this context‰ the conse«uences o the interest rate hie by the ‹„ ¥ed in ecember 201 and the direction o longŽterm interest rates raise ey «uestions or insurers… This is because income rom inancial assets is an important part o earnings‰ although not all lines o business are aected to the same degree… Œill interest rates inally rise and go bac to preŽcrisis levels¬ eneva ˜eport inds that longŽterm uring the last three decades‰ yields or 10Žyear government bonds have decreased government bond yields have allen or steadily… ‘owever‰ inlation expectations‰ calculated by the dierence in yields rom three decades‰ but inlation expectations inlationŽprotected and unprotected bonds‰ remained relatively stable‰ relecting the have remained stable… credibility o central bans’ inlation targets… recently published eneva ˜eport on the world economy thereore associates the all in yields during the last two decades with lower real interest rates‰ rather than with a decline in inlation expectations… ¢ther actors could be at play in the The inancial crisis and the subse«uent reaction o central bans caused Šust a small longŽterm downtrend in interest rates… dip in the longŽterm down trend o real interest rates… ‘ence‰ other drivers need to be at wor… The eneva report ocuses on dierent explanations“ ̤ n ageing population in most parts o the world led to an increase in the aggregate propensity to save‰ some o which went into ixed income assets‰ lowering real interest rates… ̤ nother contributing actor has been the increase in savings in —hina… The higher savings coupled with —hina’s increased inancial integration‰ led to large capital outlows into global inancial marets… ̤ shit in investor preerences away rom risy assets towards sae bonds is another liely driver or lowering real interest rates… ccording to the report‰ interest rates These actors may persist or some time‰ and re/insurers need to be prepared to could eventually rise again… cope with low interest rates or a while yet… ‘owever‰ the report also mentions that with time‰ interest rates could increase as the causes o the downward trend reverse“ ̤ ¥irst‰ aggregate savings levels could decrease as the cohort o current savers continues to move towards retirementŸ ̤ „econd‰ with the shit in —hina rom investment and exportled growth to a more consumptionŽdriven economy‰ the —hinese outlow o capital into global inancial marets may also stabiliseŸ and ̤ ¥inally‰ a gradual return o investors into more risy assets could alleviate pressure on interest rates… 5 Low for Long? Causes and Consequences of Persistently Low Interest Rates, ¢ctober 201‰ nternational —enter or ‚onetary and ¦aning „tudies †—‚¦‡ and —entre or Economic €olicy ˜esearch †—E€˜‡… Swiss Re sigma No 3/2016 ƒ

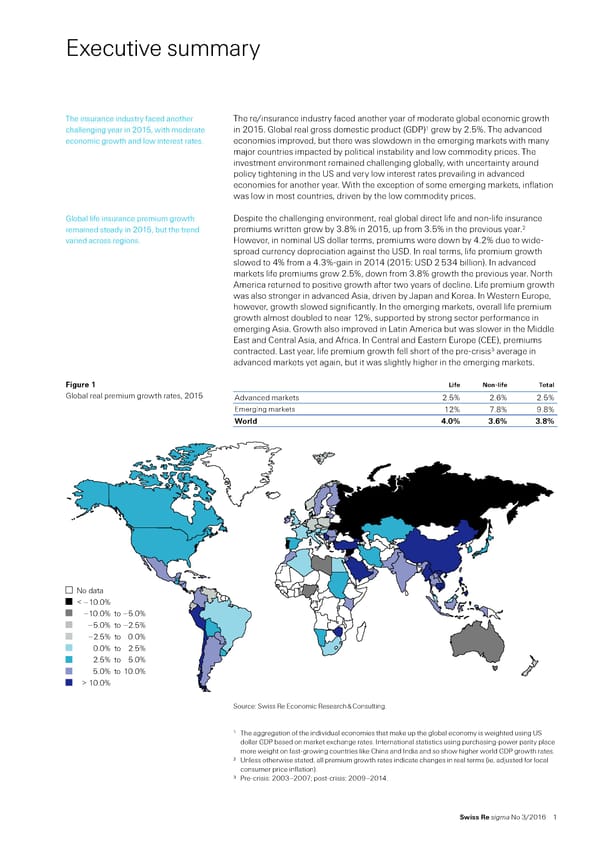

nsurance premium growth steady lobal insurance premiums continued to grow in 201 lobal premiums grew by a real 3…ˆ Total direct premiums written grew by 3…ˆ in real terms in 201‰ up rom 3…ˆ 6 in 201‰ but declined by ’…2ˆ to growth in 201’… lobal premium volumes were ‹„ ’ ’ billion‰ which in nominal ‹„ ’ ’ billion in nominal terms… terms was ’…2ˆ less than the previous year‰ due to signiicant currency depreciation against the ‹„ dollar †‹„‡… The euro lost signiicant value against the ‹„ †–20ˆ‡‰ and ‹– sterling †¦€‡ and the •apanese yen †•€µ‡ were also impacted‰ as were advancedŽmaret commodity exporters † ustralia‰ —anada‡… ‚any emerging maret †˜ussia‰ ¦ra§il‰ „outh rica‰ others‡ currencies depreciated strongly also… Figure 5 20% lobal real direct premium growth‰ 1¡0 –201 15% 10% 5% 0% –5% –10% 1 3 5 7 9 1 3 5 7 3 5 9 11 13 15 8 8 8 8 8 9 9 9 9 999 01 0 0 07 0 0 0 0 19 19 19 19 19 19 19 19 19 1 0 0 2 2 2 2 20 20 2 20 Total Non-life Life „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Figure lobal real premium growth rates‰ 201 No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… 6 ‹nless otherwise stated‰ all premium growth rates indicate changes in real terms †ie‰ adŠusted or local consumer price inlation‡… Swiss Re sigma No 3/2016

”ie insurance“ positive overall growth mass regional disparities †reiu de elo‡ent lobal lie insurance premiums rose by lobal direct lie premiums written totalled ‹„ 2 3’ billion in 201‰ down ’…6ˆ ’…0ˆ in 201‰ slightly slower than in the in nominal terms but up ’…0ˆ in real terms ater a ’…3ˆŽreal gain in 201’… n the last previous year… two years‰ global lie premium growth has exceeded both the preŽ and postŽcrisis averages †see ¥igure ƒ‡… ‘owever‰ the overall growth mass considerable variation across regions and countries… ”ast year premium growth in the advanced marets slowed‰ but accelerated in the emerging marets… Figure ˆ World ”ie premium growth in the advanced and emerging marets in 201‰ and Advanced markets preŽ and postŽinancial crisis averages North America Western Europe Advanced Asia Oceania Emerging markets Emerging markets excl. China Emerging Asia Emerging Asia excl. China Latin America and the Caribbean Central and Eastern Europe Middle East and Central Asia A…rica † „† † „† † „† † ƒroth rate „ Precrisis average groth €‚ Postcrisis average groth „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… €remium growth in the advanced n the advanced marets‰ premiums recovered in North merica ollowing two years marets slowedŸ it accelerated in o contraction… There was also renewed momentum in •apan… n ¢ceania‰ however‰ the emerging marets… marets declined sharply‰ mainly due to base eects ater very solid growth in ustralia in 201’… There was minimal growth in Œestern Europe‰ mainly due to a contraction in ermany… mong the emerging marets‰ growth was particularly strong in emerging sia‰ supported by solid gains in a number o countries including —hina‰ ndia‰ ndonesia and the €hilippines… ”ie premium growth also strengthened in ”atin merica and remained on a positive trac in rica‰ the ‚iddle East and —entral sia… The improvement in ”atin merica relects robust growth in ¦ra§il and a strong rebound in —hile… ¦y contrast‰ premiums in —EE were down or a third year running‰ mainly because o the two largest marets‰ €oland and the —§ech ˜epublic †see page 32‡… espite signs o recovery o late‰ overall espite the aboveŽaverage growth rates in 201’ and 201‰ lie insurance premiums lie premium growth has been sluggish have been sluggish since the inancial crisis in 200… ¢n average‰ advancedŽmaret since the inancial crisis… premiums have stagnated since then‰ with very little and even negative lie premium growth in Œestern Europe and North merica… The emerging marets have also slowed maredly‰ with premium growth less than hal preŽcrisis levels… Swiss Re sigma No 3/2016 ¡

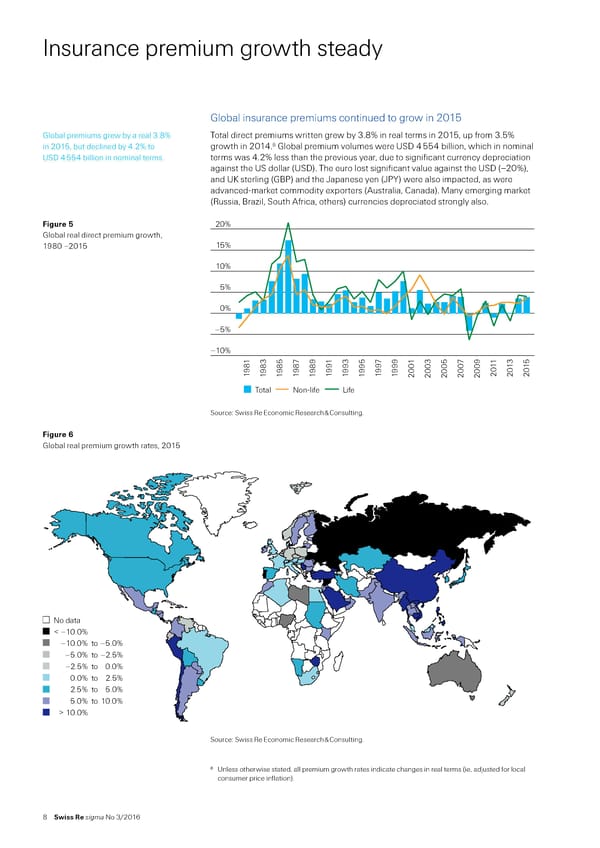

Insurance premium growth steady Figure 8 •ie real remium growth 201 No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% Source: Swiss Re Economic Research & Consulting. Life insurers’ profitability and capital position –roitailit in the lie sector remains Gloal lie inustr roitailit remaine uner ressure in 201 with return on uner ressure. ”owe‰er the inustr euit €R‚Eƒ at aout 12„ €see …igure †ƒ. R‚E is e‡ecte to remain elow reˆ is well caitalise. crisis le‰els in the nearˆ an meium term. ‚ngoing heawins are the moerate remium growth in man marŠets an rolonge low interest rates. ‹n some countries on iels are e‰en negati‰e. ‹nsurers rom Canaa an Œestern Euroe in articular contriute to the weaŠ earˆonˆear €oƒ R‚E outcome in the ourth uarter o 201. Žmong ‘S insurers most o the imro‰ement in a‰erage R‚E was ecause o an increase in the net income o one coman ue to ositi‰e ore‡ e‰eloments. …rom an accounting ersecti‰e the lie sector reorte stronger caitali’ation at the en o 201 than in 201“ relecting soli results in China. ”owe‰er the imro‰ement was also artl ri‰en ecreasing interest rates leaing to a higher marŠˆtoˆmarŠet ‰alue o i‡eˆincome an eri‰ati‰e in‰estments. 10 Swiss Re sigma No 3/2016

Figure ‹ ˜eturn on e«uity †let panel‡ and shareholder e«uity †right‡ o large lie insurers and globals with lie business 25… 325 (4Q07 = 100) 20… 300 275 15… 250 225 10… 200 5… 175 150 0… 125 –5… 100 75 –10… 50 7 ƒ ƒ ‚ ‚ 0 0 1 1 2 2 3 3 4 4 5 5 7 ƒ ƒ ‚ ‚ 0 0 1 1 2 2 3 3 4 4 5 5 4Q0 2Q0 4Q0 2Q0 4Q0 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 4Q0 2Q0 4Q0 2Q0 4Q0 2Q14Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q14Q1 3 Canadian companies 10 companies 7 ropean o€as 2 Chinese companies companies Market cap weighted average ƒ Note“ ¦ased on a sample o companies ‰ missing 1·/3· values are interpolated… „ources“ —ompany reports‰ ¦loomberg‰ „wiss ˜e Economic ˜esearch ™ —onsulting… Life insurance industr€ outloo„ ”ie premiums will liely grow in the ”ie premiums are expected to grow in both the advanced and emerging marets in advanced and emerging marets in 2016 … 2016… rowth is orecast to accelerate slightly in the advanced but decelerate in the emerging countries… The small improvement in the advanced marets will come rom an expected recovery in ¢ceania and modest acceleration in Œestern Europe… n North merica‰ growth will remain roughly stable… n the emerging marets‰ the pace o growth relects sustained strong perormance in emerging sia… €remium growth in —hina‰ though slowing‰ is expected to remain strong in 2016… The astŽgrowing sharia compliant/taaul business in ndonesia and ‚alaysia is expected to urther beneit the lie sector… n contrast‰ growth in ”atin merica will remain below recent trend levels due to price competition‰ demand weaness and heightened inancial and economic volatility… ”ie premiums will also remain under pressure in most —EE E‹ countries‰ and are expected to decline in ˜ussia due to the ongoing economic diiculties there… n rica‰ lie insurance penetration is still very low‰ so there is ample potential or growth… … although the overall environment will nterest rates and the macroeconomic and inancial maret environment will continue remain challenging… to shape the outloo or the primary lie insurance industry… ownside riss rom Šust modest global economic growth‰ persistently low interest rates‰ volatility in the inancial marets and regulatory changes remain signiicant in the shortŽ and mediumŽterm… Œith proitability under pressure‰ lie insurers will continue to ocus on improving capital management‰ lowering expenses and enhancing investment yields… 7 ¥” —Ÿ llian§Ÿ ssurant ncŸ vivaŸ ® Ÿ —hina ”ieŸ —N€Ÿ eneraliŸ enworth ¥inancialŸ reatŽŒest ”iecoŸ ‘artordŸ ”egal ™ eneralŸ ”incoln NationalŸ ‚anulieŸ ‚et”ie roupŸ ¢ld ‚utualŸ €ing nŸ €rudential †‹–‡Ÿ €rudential †‹„‡Ÿ „t… •ames €lace Ÿ „tan—orp ¥inancial roupŸ „tandard ”ieŸ „torebrand „ Ÿ „un ”ieŸ „wiss ”ieŸ TorchmarŸ ‹N‹‚ roupŸ ¹urich… Swiss Re sigma No 3/2016 11

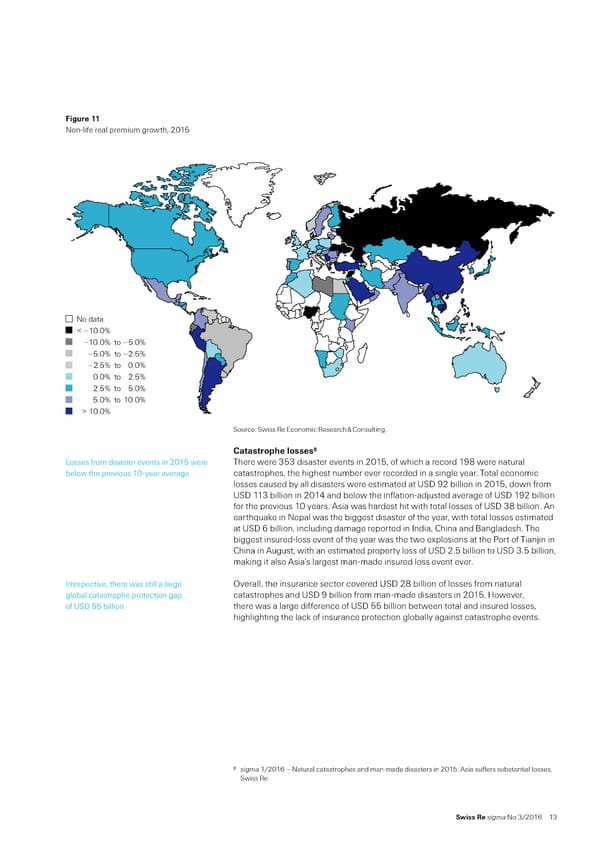

‰nsurance ‡reiu growt‚ stead€ NonŽlie“ higher premium growth‰ driven by advanced marets Non-life insurance ‡reiu de elo‡ent lobal nonŽlie premium growth lobal nonŽlie insurance sector improved urther in 201‰ with premiums up 3…6ˆ in improved urther in 201‰ mainly real terms to ‹„ 2 020 billion‰ higher than the 2…’ˆŽgain registered in 201’ and driven by advanced marets… also better than preŽcrisis average growth †see ¥igure 10‡… ‘owever‰ in nominal ‹„ terms‰ premiums ell 3…ˆ due to currency depreciations against the dollar… The advanced marets were the main drivers‰ with higher growth registered in all regions except ¢ceania †lat at £0…1ˆ‡… dvanced sia †£’…1ˆ‡ registered the highest growth among the advanced regions and premiums in North merica were also solid †£3…2ˆ‡… Œestern Europe premiums showed moderate growth †£1…ˆ‡ ater several years o stagnation… Figure 10 World NonŽlie premiums growth in the advanced and emerging marets in Advanced markets 201‰ preŽ and postŽinancial crisis North America averages Western Europe Advanced Asia Oceania Emerging markets Emerging markets excl. China Emerging Asia Emerging Asia excl. China Latin America and the Caribbean Central and Eastern Europe Middle East and Central Asia Africa †‡ ‚‡ ‡ ‚‡ †‡ ‡ ‡ …‡ „roth rate … recrisis average groth ‚ ƒ ostcrisis average groth € „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Emerging maret premiums growth n the emerging marets‰ premium growth slowed to a stillŽrobust ƒ…ˆ in 201 rom slowed but remained solid… …6ˆ in 201’‰ but was below the preŽcrisis average o 10ˆ… rowth trends among regions were mixed… —hina was the main driver‰ with premiums there increasing by 1ƒˆ… n the ‚iddle East and —entral sia‰ growth remained solid at ¡ˆ‰ and liewise in emerging sia excluding —hina at …¡ˆ… ‘owever‰ in most regions the level o premium growth was lower than in 201’… rowth was slow in rica †£1…3ˆ‡ and ”atin merica †£2…3ˆ‡… This was still higher than in —EE where premiums were down ’…¡ˆ‰ with sharp contractions in ˜ussia and the ‹raine osetting more positive results in other countries… 12 Swiss Re sigma No 3/2016

Figure 11 NonŽlie real premium growth‰ 201 No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Œatastro‡‚e losses ”osses rom disaster events in 201 were There were 33 disaster events in 201‰ o which a record 1¡ were natural below the previous 10Žyear average… catastrophes‰ the highest number ever recorded in a single year… Total economic losses caused by all disasters were estimated at ‹„ ¡2 billion in 201‰ down rom ‹„ 113 billion in 201’ and below the inlationŽadŠusted average o ‹„ 1¡2 billion or the previous 10 years… sia was hardest hit with total losses o ‹„ 3 billion… n earth«uae in Nepal was the biggest disaster o the year‰ with total losses estimated at ‹„ 6 billion‰ including damage reported in ndia‰ —hina and ¦angladesh… The biggest insuredŽloss event o the year was the two explosions at the €ort o TianŠin in —hina in ugust‰ with an estimated property loss o ‹„ 2… billion to ‹„ 3… billion‰ maing it also sia’s largest manŽmade insured loss event ever… rrespective‰ there was still a large ¢verall‰ the insurance sector covered ‹„ 2 billion o losses rom natural global catastrophe protection gap catastrophes and ‹„ ¡ billion rom manŽmade disasters in 201… ‘owever‰ o ‹„ billion… there was a large dierence o ‹„ billion between total and insured losses‰ highlighting the lac o insurance protection globally against catastrophe events… 8 sigma 1/2016 – Natural catastrophes and manŽmade disasters in 201“ sia suers substantial losses‰ „wiss ˜e… Swiss Re sigma No 3/2016 13

‰nsurance ‡reiu growt‚ stead€ Non-life insurers’ ‡rofitaƒilit€ and ca‡ital ‡osition NonŽlie proitability weaened in 201 The overall proitability o nonŽlie insurance‰ measured by ˜¢E‰ declined rom ¡…0ˆ due to low investment returns and weaer in 201’ to ƒ…2ˆ in 201… ‹nderwriting and investment results both declined… underwriting results… nvestment income as a percentage o net premiums earned in eight maŠor marets ell by 0…ƒ ppt to ¡…2ˆ in 201 †see ¥igure 12‡ due to the low interest rate environment… ‹nderwriting results were also down as the pace o reserve releases slowed… ¢verall‰ underwriting proitability in the eight marets deteriorated with the combined ratio moving up to ¡…¡ˆ in 201 rom ¡ƒ…6ˆ in 201’… n the ‹„‰ the industry combined ratio worsened due to rising claims in motor and general liability insurance… n the ‹– and continental Europe‰ motor underwriting results started to deteriorate again ater some improvements previously… n •apan‰ overall underwriting results improved across all lines‰ but the combined ratio in the compulsory motor line remained high… ‹nderwriting perormance in ustralia‰ however‰ deteriorated due largely to poor results in property osetting improvements in compulsory motor… The overall negative trend in proitability is expected to continue in 2016… Figure 12 0% Aggregate of the US, Canada, the UK, Germany, France, Italy, Japan and Atrala —omposition o proits as a ˆ o net 15% premiums earned and ˜¢E‰ aggregate o eight maŠor marets‰ 1¡¡¡–2016 10% 5% 0% –5% –10% –15% 1 000 001 0000 00 00500 00€ 00‚ 00010 011 01 0101 015ƒ01F Under‹rtng relt a a % of net premm earned E = estimate Crrent nŠetment ncome a a % of net premm earned F = forecast Captal gan‰loe a a % of net premm earned After„ta… retrn on e†ty ‡%ˆ „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… The nonŽlie industry is well capitali§ed… The nonŽlie sector remains well capitalised with solvency at a record high o 130ˆ in 201‰ up rom 12’ˆ in 201’… Nevertheless‰ shareholder e«uity in the eight marets declined marginally in ‹„ terms due to negative currency eects as the ‹„ strengthened… ¢n a local currency basis‰ shareholder e«uity increased… lthough capitalisation is expected to remain strong‰ the support rom higher unrealised gains due to ultraŽlow interest rates will disappear once rates begin to rise †in the ‹„ and ‹– mainly‡… 1’ Swiss Re sigma No 3/2016

Figure 1 USD bn Aggregate of the US, Canada, the UK, Germany, France, Italy, Japan and Australia NonŽlie insurers’ solvency‰ 1¡¡¡–2016 1400 140% 1200 120% 1000 100% 800 80% 600 60% 400 40% 200 20% 0 0% 01 02 03 04 05 06 07 08 09 10 11 12 13 14 E F 999 000 20 20 20 20 20 15 16 1 2 20 20 20 20 20 20 20 20 20 20 20 remiums earned estimate Shareholders euity F forecast Solency euitypremiums – ‚ƒS„ „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Non-life insurance industr€ outloo„ ”ower premium rates and wea lobal nonŽlie sector growth is expected to weaen due to moderate economic economic growth will drag on nonŽlie activity and sot pricing‰ mainly in the advanced marets… n North merica‰ premium premium development in advanced growth is expected to slow slightly in 2016 because o price declines in most marets… commercial lines… n Œestern Europe‰ nonŽlie premium growth will remain subdued due to moderate economic recovery… n advanced sia‰ a weaening economic environment will pose challenges to most o the nonŽlie sector‰ but some lines are expected to grow †eg‰ accident ™ health‰ due to increasing awareness and product reŽpricing‡… The nonŽlie sector in ¢ceania will liely be aected by pricing pressures and also regulatory changes †see page 2ƒ‡… rowth in Emerging sia will remain The outloo or emerging marets is mixed… Emerging sia is orecast to grow strong‰ mainly driven by —hina… robustly‰ mainly driven by —hina because o government support or insurance… ¥urther bacing will come rom rate hies in motor thirdŽparty liability †‚T€”‡ insurance in ndia and inrastructure investments in other sian marets… ‘owever‰ detariication o motor in —hina and ‚alaysia could oset some o the positive momentum in the region… NonŽlie premiums in rica and the ‚iddle East and —entral sia will continue to grow but at a lower rate than beore… n ”atin merica‰ growth is expected to be lat due to contraction in ¦ra§il and ¨ene§uela‰ and slower growth in rgentina… n —EE‰ nonŽlie premiums are expected to decline urther due to contraction in ˜ussia‰ where the economy remains stuc in recession… ¢verall nonŽlie sector proitability will NonŽlie insurers’ proitability is expected to continue to be under pressure as remain subdued… investment returns remain depressed and sot maret conditions continue… Swiss Re sigma No 3/2016 1

lobal trade and insurance maret growth ntroduction Trade volumes grew about twice as ast Trade data o the last 10 years tell a straightorward story“ excluding periods o as global output in the two decades prior recession‰ and during and between Œorld Œars and ‰ growth in global trade volumes mostly exceeded growth in global real €…¡ to 200ƒ … The outperormance was most pronounced rom the late 1¡0s to midŽ2000s‰ with trade volumes growing about 10 twice as ast as real €… This was relected by an increase in exports as a share o € rom below 1ˆ to more than 30ˆ during that time †¥igure 1’‡… … driven by maŠor geoŽpolitical and The gains were based on a series o maŠor geoŽpolitical and economic events“ the economic events… end o the —old Œar and reintegration o the —EE countries into the world economyŸ the adoption o an exportŽled growth model in —hina and its integration into global businessŸ the ‹ruguay ˜ound trade negotiations between 1¡6 and 1¡¡’‰ leading to the creation o the Œorld Trade ¢rganisation †ŒT¢‡ and a reduction in average tarisŸ rapid innovation in inormation and communications technologyŸ and ongoing improvements in transport eiciency… ¢ptimisation o production processes with more outsourcing o speciic unctions over time led to a rise in global supply chains… Figure 14 evelopment o global exports relative 0.40 to global € 0.35 Exports to GDP (nominal) 0.30 Exports to GDP (real) 0.25 0.20 0.15 0.10 70 75 80 85 90 95 000 05 10 15 19 19 19 19 19 19 2 20 20 20 Exports to GDP (real)Exports to GDP (nominal) Pre-crisis tren (real) ecessions rey bars indicate global recessions‰ e«uali§ed with global real € growth below 1ˆŸ the dashed line shows the preŽcrisis trends according to the average growth rates between 1¡¡0 and 200ƒ… „ource“ Œorld ¦an‰ „wiss ˜e Economic ˜esearch ™ —onsulting… ‘owever‰ trade has grown in line with There has been a slowdown in global trade in more recent years… This appears more € in more recent years… pronounced in nominal terms than in real terms because“ ̤ ‹„ appreciation“ national values need to be converted to a common currency‰ typically the ‹„… stronger ‹„ reduces the value o exports denominated in other currencies‰ even i prices in local currency terms and volumes increase… The same applies to world €… ‘owever‰ as the ‹„ accounts or a smaller share o world trade than it does or world €‰ converting local currencies to ‹„ to aggregate nominal trade and € causes the ratio between the two variables to decline as the ‹„ appreciates… ̤ ¥alling commodity and manuacturing prices in recent years have led to lower export prices †see ¥igure 1‡… —ommodities and manuactured goods account or a larger share o trade than they do or global output… ecreasing commodity and manuacturing prices thereore have a larger negative eect on nominal exports than on nominal €‰ causing the ratio between the two variables to decline… 9 … rwin‰ “”ongŽrun trends in world trade and income”‰ World Trade Review, 1†1‡ 2002‰ pp… ¡–100… 10 —… —onstantinescu‰ … ‚attoo and ‚… ˜uta‰ “The lobal Trade „lowdownŸ —yclical or „tructural¬”‰ IMF Woring Paers, 1†6‡‰ 201… 16 Swiss Re sigma No 3/2016

Figure 15 140 lobal manuacturing and export price 130 Export price index indices †200¯100‡ 120 Manufacturing price index 110 100 90 80 70 2 4 6 8 2 4 6 8 10 12 14 16 9 9 9 9 000 0 0 0 0 0 0 0 0 19 19 19 19 2 20 20 20 20 2 2 2 2 Manufacturing price index Export price index „ource“ —€¦ Netherlands ¦ureau or Economic €olicy nalysis‰ „wiss ˜e Economic ˜esearch ™ —onsulting… This raises «uestions regarding the outloo ‹„ aggregation eects overstate the magnitude o the recent slowdown in trade‰ o the global tradeŽtoŽ€ ratio… but it is also visible in real terms… This raises the «uestion o whether the trade slowdown is cyclical or relects a structural change in the world economy… nd‰ i the latter‰ how will the decrease in the tradeŽtoŽ€ growth ratio impact global economic growth¬ eterminants o the slowdown Œ€clical factors uring recession‰ the purchase o traded Trade volumes normally respond more than proportionally to movements in real €… 11 goods is oten postponed‰ resulting in rwin explains this by citing that demand or investment and durable consumer high sensitivity o trade volumes to € goods is cyclical‰ growing rapidly in times o strong economic perormance… s these moves… goods represent a large share o global trade volumes‰ recent weaness in global growth is liely having a negative impact on the tradeŽtoŽ€ ratio… ntraŽE‹ trade matters disproportionally The regional composition o world growth is also important… n particular‰ sluggish or global trade‰ and E‹ € growth has growth in the E‹ in recent years has had a disproportionally large impact on global been wea or the last several years… trade volumes“ the E‹ accounts or less than one «uarter o global output‰ but or more than one third o global trade… The substantial trade lows between E‹ member states are included as part o global trade statistics… ‘owever‰ trade within large countries †eg‰ the ‹„ or —hina‡ is not included… —yclical actors explain some o the nother cyclical actor in the tradeŽvolume slowdown since 200ƒ is that economic recent slowdown… growth in many emerging marets has been wea relative to the previous two decades… eopolitical tensions‰ exchange rate luctuations‰ and the holding o o investments because o an uncertain outloo has also contributed to lower lows… 11 rwin‰ op… cit… Swiss Re sigma No 3/2016 1ƒ

Žloƒal trade and insurance ar„et growt‚ Figure 1 25 lobal exports in ‹„ trillion 20 15 10 5 0 19801982 1984 19861988 1990 1992 19941996 1998 20002002 2004 2006 20082010 2012 2014 Services exports Agriculture Fuels and mining Manufactures „ource“ ŒT¢‰ „wiss ˜e Economic ˜esearch ™ —onsulting… Structural factors The slowdown in global trade is based The recent slowdown in trade relative to € growth results rom sluggishness in on sluggishness in trade o goods… Trade trade o goods‰ in particular in manuacturing‰ uel and mining products… ¦y contrast in services continues to exceed income trade in services is still growing at a much higher rate than global €… ‘owever‰ as growth… ¥igure 16 shows‰ services still account only or about one ith o global trade… The slowdown in global trade‰ thereore‰ is about structural changes in the production and trade o goods rather than services… The expansion o international supply The rapid expansion o international production networs/supply chains is an chains was an important driver o global important actor in explaining the outperormance o trade relative to income growth 12 trade in the two decades prior to the in the two decades prior to 200ƒ… Trade is measured on a gross value basis… a midŽ2000s… good which consists to a large part o imported intermediate goods is exported‰ the imported intermediate goods are recorded again in a country’s exports… n contrast‰ € only measures the value added in the exporter country… ‘ence‰ in the years beore 200ƒ‰ the rise o global value chains led to a large increase in the tradeŽtoŽ € ratio… ¢shoring is a tradeŽo between ccording to theory‰ the undamental tradeŽo in supply chain dispersion is between 13 specialisation gains and coordination specialisation gains and coordination costs… The revolution in inormation and costs… communication technology radically lowered coordination costs in the 1¡¡0s and early 2000s… ‘owever‰ the recent slowdown in oshore activities indicates that a urther substantial reduction in communication costs might be hard to achieve… n addition‰ narrowing wage gaps between countries lie —hina and advanced 1’ economies could lower specialisation gains… —onstantinescu et al… ind evidence that the slowing pace o international vertical speciali§ation might be another structural change aecting the tradeŽtoŽincome relationship… The E—¦ supports this inding by presenting evidence rom the Œorld nputŽ¢utput atabase… The share o oreign value added in gross exports increased until 200‰ and has remained broadly unchanged since 200¡… ‘igh wages in some emerging marets appear to be reducing dependence on oreign supply chains as manuacturers shit production bac to their home country… 12 … aulier‰ … „antoni‰ … Taglioni et al…‰ “The power o a ew in determining trade acceleration and slowdowns” in ¦… ‘oeman †ed‡… Te loal Trade lowdown €ew €ormal?, ¨oxE‹ ¦oo‰ 201… 13 ˜… ¦aldwin‰ “lobal supply chains“ Œhy they emerged‰ why they matter‰ and where they are going”‰ C‚PR ƒiscussion Paers, vol ¡103‰ 2012… 14 —… —onstantinescu‰ … ‚attoo and ‚… ˜uta‰ op… cit… 1 Swiss Re sigma No 3/2016

ˆn important structural actor is China’s There is a general consensus that developments in China have contributed to both transition rom an e€port-led to a the large increase in the trade-to-income ratio in the high-trade growth period prior consumption driven growth model to 200 and also to the ratio’s decline during the trade slowdown o more recent 1 and the declining import content o its ears rior to the mid-2000s China’s e€port-led growth model was a main driver 16 e€ports o global trade volumes ‚oreover ƒaulier et al argue that China’s economic integration also had a “…uggernaut eect” on trade liberalisation in ‡outheast ˆsian countries – ie a virtuous ccle in which trade liberalisation strengthens the e€port sector which in turn lobbies or urther trade liberalisation Šith China’s transition rom an e€port- and investment-led to a more consumption and service-based growth model a large driver o global trade growth has diminished The rebalanced Chinese econom with a higher emphasis on growth in the less trade-intensive service sector and domestic consumption will contribute less to global trade 1 ‹urther Constantinescu et al state that the share o Chinese imports o parts and components in its total e€ports has declined rom a peaŒ o Ž in the mid-1990s to around 3 Ž currentl China’s increasing abilit to source rom itsel has contributed to the sluggish development o the global trade-to-ƒ‘ ratio in recent ears Figure 17 16 ˆverage import taris or dierent 14 regions in Ž 12 10 8 6 4 2 0 1 3 5 7 3 5 9 11 13 9 9 9 9 999 01 0 0 07 0 0 0 19 19 19 19 1 0 0 2 2 2 20 20 2 20 World North America Europe Middle East Asia ‡ource’ Šorld “anŒ ‡wiss ”e •conomic ”esearch – Consulting «arge trade liberali™ation deals supported The •C“ claims that protectionism ma be plaing “a small but non-negligible role” 1— the increase in the trade-to-income ratio in the most recent trade slowdown ˜owever even a stagnating level o trade during the 1990s and earl 2000s but liberalisation would not drive the trade-to-ƒ‘ ratio higher ‹igure 1 shows the there have been ew notable agreements average import taris in percentage points or dierent regions since the earl 1990s recentl ‘uring this period in which global trade volumes grew twice as ast as output average taris across the world ell signiicantl ˆverage taris levelled o at low levels in the ears ater the inancial crisis and an urther declines ma onl have a marginal impact The stagnation in liberali™ation initiatives since the mid-2000s ma have also slowed trade growth relative to output ‹uture prospects and implications or growth œn coming ears trade will most liŒel There is no agreement on the relative importance o cclical versus structural actors not increase twice as ast as ƒ‘ in trade growth but there is strong evidence that both are at pla ˆmong others 19 “o™ et al argue that on balance cclical orces have been more important ˜owever ƒaulier et al20 and others argue that structural changes were responsible or a signiicant part o the recent slowdown ƒlobal trade should picŒ up again once global economic activit accelerates but is unliŒel to return to double-ƒ‘-growth 15 œbid 16 ƒ ƒaulier ƒ ‡antoni ‘ Taglioni op cit 17 C Constantinescu ˆ ‚attoo and ‚ ”uta op cit 18 “¢nderstanding the weaŒness in world trade” ECB Economic Bulletin, vol 3 201 19 • “o™ ‚ “ussière and C ‚arsilli “”ecent slowdown in global trade’ Cclical or structural¥” in “ ˜oeŒman ¦ed§ The Global Trade Slowdown: A New Normal? ¨o€•¢ “ooŒ 201 20 ƒ ƒaulier ƒ ‡antoni ‘ Taglioni op cit Swiss Re sigma No 3/2016 19

Žloƒal trade and insurance ar„et growt‚ rates… —hanges in underlying actors causing the recent decline o the tradeŽtoŽ€ ratio are liely to persist“ —hina’s transition to a more consumption and serviceŽdriven growth model will proceed‰ and gains rom urther international dispersion o production networs may have peaed… T€€ and TT€ might be a source or a t is unclear whether protectionism or trade liberali§ation measures will gain the renewed boost to the tradeŽtoŽ€ ratio… upper hand in the years to come… The TransŽ€aciic €artnership †T€€‡ reached agreement in ¢ctober 201‰ but the accord still needs to be signed and ratiied by participating countries… t should positively aect the tradeŽtoŽ€ ratio‰ although estimates on the potential impact on trade volumes and economic growth vary greatly… proposed Transatlantic Trade and nvestment €artnership †TT€‡ between the ‹„ and the E‹ is still being negotiated… Œhen and in what orm the agreement will come into orce is uncertain… Œea global trade growth will liely No current academic literature explicitly investigates the impact o the recent global dampen global economic growth… trade slowdown on global growth… ¦ut there is a large body o literature lining increases in productivity to trade in general‰ and to various aspects o dispersing the global value chain in particular…21 This material says a stagnating or decreasing tradeŽ toŽ€ ratio may have a negative eect on global growth as trade is a channel or nowledge transer and diusion o technologies‰ as well as or speciali§ation and resource allocation according to the theory o comparative advantage… mplications or insurance ˜ates determine marine insurance €remium rates tend to be cyclical‰ and are the most important determinant o marine premiums in the short run… Trade and credit insurance premiums in the short run… ‘owever‰ over the longer term‰ activities are the main determinant o premiums are mostly determined by the level o insurance exposure… persistent premiums in the long run… slowdown in global exports would directly lower exposure growth and would thereore have a negative impact on marine and credit insurance premiums… Taƒle 1 Long-run res‡onse ’ erage real Ž“† †ro”ected a erage real ‡reiu growt‚ if trade: „cenarios or the development o marine of ‡reius to trade growt‚ forecast o er grows in tande wit‚ grows twice as fast as premiums over the next 10 years t‚e net 10 €ears real Ž“† real Ž“† —argo 0…¡ 2…ˆ 2…ˆ …0ˆ ‘ull 0…0 2…2ˆ ’…’ˆ „ource“ ‚¥ Œorld Economic ¢utloo‰ „wiss ˜e Economic ˜esearch ™ —onsulting… 22 ‘arine insurance ˜ising trade activity increases cargo and ata rom the last two decades reveals that an increase o trade activity by 1ˆ hull premiums‰ but not by as much as the eventually leads to an increase in cargo premiums o slightly below 0…¡ˆ‰ and to increase in trade… an increase in hull premiums o about 0…ˆ… ¢ver the last 20 years‰ this longŽrun response o premiums to the value o traded goods has tended to be below 1…0… The reason might be ound by commercial pressures in the shipping industry… —redit availability and overly optimistic trade growth proŠections led to substantially increased orders or new ships rom 200’ to 200… The overhang o shipping capacity and resulting wea prices in maritime reight marets put pressure on premium rates… lso‰ saety may be rising‰ lowering the ris and the premium rates… trend towards larger ships has ept Œhile cargo premiums can be directly lined to the value o traded goods‰ trade only average hull premium below cargo indirectly aects hull premiums through the assumption that the global value o ships premium growth rates… is connected to the total value o its cargo… The excess supply o shipping capacity 21 „ee ‚… miti and •… –onings‰ “Trade ”iberali§ation‰ ntermediate nputs‰ and €roductivity“ Evidence rom ndonesia”‰ merican ‚conomic Review‰ vol ¡ƒ‰ no 200ƒ‰ pp 1611–163… lso €… –… oldberg‰ … –… –handelwal‰ N… €avcni et al…‰ “mported ntermediate nputs and omestic €roduct rowth“ Evidence rom ndia”‰ …uarterly †ournal of ‚conomics‰ vol 12‰ no ’ 2010‰ pp 1ƒ2ƒ–1ƒ6ƒ‰ and … ‚… rossman and E… ˜ossiŽ‘ansberg‰ “Trading Tass“ „imple Theory o ¢shoring…” merican ‚conomic Review‰ vol ¡‰ no 200‰ pp 1¡ƒ–¡ƒ… 22 The econometric analyses in this chapter ollows the methodology used in sigma ’/2013“ Navigating recent developments in marine and airline insurance‰ „wiss ˜e… 20 Swiss Re sigma No 3/2016

led to a decrease in ships’ market value. This and a trend towards larger ships, carring more cargo or less cost, might also eplain the lower longrun response o hull premiums to trade relative to cargo premiums. ™ongrun premium growth orecasts are sing an eternal orecast or gloal real € growth, Tale 1 presents two scenarios highl dependent on the uture path o or average real growth rates o cargo and hull premiums over the net 10 ears‚ tradeto € ratio. an upside scenario in which trade is assumed to grow twice as ast as € as during the period etween 1ƒƒ0 and 200„… and a downside scenario in which trade is assumed to grow at the same pace as gloal €. †rom these scenarios, cargo premiums are orecast to grow on average etween 2.‡ˆ and ‡ˆ, and hull premiums etween 2.2ˆ and ‰.‰ˆ. Šhile shortrun prospects o marine premiums are mainl driven the development o premium rates, long run prospects are highl dependent on the uture development o the tradeto € ratio. Trade credit insurance23 “igher eports tpicall lead to an sing historical data rom ‰0 countries, an evaluation was conducted o the eect increase in trade credit insurance o eports on trade credit insurance premiums. The analsis estimates that a 1ˆ premiums. increase in eports is accompanied a 0.6„ˆ increase in trade credit insurance premiums. Trade credit insurance protects sellers o products and services against the risk o nonpament the uer. ‹ince this also includes domestic uers, eport data onl capture a part o the eposure to nonpament. The rest o the eposure depends on the development o the economic activit within a countr, which in turn also aects trade. Œter controlling or these eects Žie, keeping the level o gloal economic activit constant‘, the analsis shows that a 1ˆ increase o trade results in a ’ust 0.32ˆ increase in trade credit insurance premiums. “owever, that is still signiicant. ”oreover, as with the analsis on the impact o trade on marine lines, the estimates do not account or a possile negative impact o a gloal trade slowdown on economic activit. Conclusion —ver the net decade, marine and trade The longrun prospects o marine and trade credit insurance lines are signiicantl credit insurance premiums are likel to aected the development o the tradeto € ratio. This ratio should pick up in develop more modestl than previousl. the coming ears as the gloal econom recovers. “owever, the recent slowdown in trade growth also relects, to a certain etent, permanent structural changes in the gloal econom. ”ost o the mentioned actors are likel to persist, pointing to more modest development o marine and trade credit insurance premiums than would have een epected several ears ago using onl real € growth rates. 23 †or an economic analsis o the trade credit insurance market, see Trade credit insurance & surety: taking stock after the financial crisis, —ctoer 201‰, ‹wiss ˜e. Swiss Re sigma No 3/2016 21

dvanced maret premiums grow aster than € lobal share o advanced marets declined to 1…3ˆ in 201 dvanced countries continued to lose Total premiums in the advanced marets grew by 2…ˆ in 201‰ little changed rom global insurance maret share in 201 the previous year… n nominal ‹„ terms‰ however‰ premiums declined by …ƒˆ to due to exchange rate depreciation… ‹„ 3 ƒ0’ billion due to widespread exchange rate depreciation‰ particularly in the euro §one‰ ustralia and —anada… Exchange rate weaness against a resilient —hinese renminbi also contributed to the decline in the advanced marets’ share o global insurance premiums to 1…3ˆ †201’“ 2…6ˆ‡… Life insurance ”ie insurance premiums grew slightly Total lie premiums in the advanced marets grew by 2…ˆ in 201‰ outpacing € aster than the economy‰ … growth slightly and increasing insurance penetration marginally †premiums/€‡… n 1ƒ o the 2 marets or which data are available †see ¥igure 1 in which the blue dots above the line indicate premium growth above € growth‡‰ lie premiums growth outpaced economic growth… Figure 1 20€ ”ie and nonŽlie premium growth versus € growth in the advanced marets‰ 201 15€ ingapore 5 10€ 1 Finland ong ong weden 0 Portugal h 2 5€ wt o r 0€ pain Greece emium g5€ eal pr10€ Netherlands ustralia R Luemourg 15€ 20€ Portugal 0‚5€ 0€ 0‚5€ 1‚5€ 2‚5€ ƒ‚5€ „‚5€ Real GDP growth 2015 Life insurance Non-life insurance GDP growth e ual to premium growth „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Non-life insurance … as did nonŽlie premiums… n nonŽlie‰ total premiums in the advanced marets grew by 2…6ˆ in 201‰ also more than the overall economy… €remium growth was stronger than € growth in 16 o the 2 marets with data… 22 Swiss Re sigma No 3/2016

‰nsurance ‡enetration and densit€ €er capita spending on insurance in n 201‰ average per capita spending on insurance in advanced marets was advanced marets decreased in 201… ‹„ 3’’0‰ down almost 6ˆ rom the previous year due primarily to exchange rate movements… €er capita spending on lie insurance was ‹„ 1¡’ and in nonŽlie it was ‹„ 1’6… €enetration remained at the same level since it is unaected by exchange rate movements… Figure 1‹ nsurance density and penetration in advanced marets‰ 201 Premiums in USD 0 1000 2000 3000 4000 5000 6000 7000 8000 Switzerland Hong Kong Luxembourg Finland Denmark Netherlands United Kingdom United States Taiwan Ireland Singapore G7 Norway Japan Average Sweden France Canada South Korea Australia EU, 15 countries Belgium Italy Germany Austria New Zealand Israel Portugal Spain Iceland Malta Cyprus Greece 0% 5% 10% 15% 20% Premiums as a % of GDP Non-life premiums per capita Life premiums per capita Total insurance penetration (lower axis) „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Swiss Re sigma No 3/2016 23

’d anced ar„et ‡reius grow faster t‚an Ž“† North merica“ lie premiums rebound‰ nonŽlie growth strengthens Life insurance ”ie premiums in the ‹„ rebounded in n the ‹„‰ lie premiums rebounded by 3…¡ˆ in 201 †201’“ –2…0ˆ‡… ndividual lie 201‰ driven by stronger group and business advanced at a healthy pace‰ driven by robust increases in universal lie and individual lie sales… whole lie sales due to attractive product guarantees… ter two years o declines‰ premiums in the group lie and annuity segment surged‰ supported by stronger income and employment growth… ”ow interest rates and returns rom alternative investments led to lower investment yields… n addition‰ actuarial reviews led to lower interest rate assumptions and conse«uent reserve increases… The industry’s ˜¢E‰ at 11ˆ‰ was unchanged and still short o preŽcrisis levels o around 1ˆ… —apital levels remained solid at most companies… n —anada‰ macroeconomic headwinds intensiied with premium growth slowing to 2…¡ˆ in 201… roup sales remained strong‰ and new individual protection products contributed to growth †eg‰ universal lie products‡… Œhole lie policies also remained attractive‰ particularly participating policies… ndividual annuities contracted due to adverse inancial marets which also pressured lie insurers’ investment income‰ dragging ˜¢E to …ˆ †201’“ 11…6ˆ‡… This year‰ ‹„ lie insurer proitability n the ‹„‰ growing employment and consumer spending should support demand or will remain under pressure… insurance in 2016… Œith interest rates expected to remain low and inancial maret volatility to linger‰ industry proitability will remain under pressure… ”ie insurers will continue to ocus on improving capital management‰ lowering expenses and enhancing investment yields… n —anada‰ premium growth should improve alongside the economy and reach trend growth in 201ƒ… €roitability will remain stable and capitali§ation solid… new capital ramewor expected in midŽ2016 †implementation in 201‡ is not expected to change the assessment o industry capitali§ation… Non-life insurance NonŽlie premiums continued to grow in n the ‹„‰ nonŽlie premiums grew by 3…1ˆ in 201‰ despite a still sot pricing the ‹„ and —anada in 201‰ despite sot environment… rowth was strongest in commercial auto and inland marine‰ ollowed pricing in the ‹„… by general liability and worers compensation… ‘owever‰ overall premiums in personal lines grew more strongly than in commercial lines‰ with pricing down in the Nort‚ ’erica ‡reius• 2015 latter… ccident and health † ™‘‡ premiums grew only slowly ater a steep drop in Œorld 201’ due to a reclassiication o a company as a health insurer… €roitability beneited ‹„ bn maret share rom reserves releases‰ though at a slower pace than in the previous year‰ and rom ”ie 602 2’ˆ benign catastrophe losses‰ but investment income stagnated… ¢verall sector ˜¢E NonŽlie 2¡ ’1ˆ declined to 6…¡ˆ in 201… n —anada‰ nonŽlie premiums grew by ’…2ˆ in 201‰ up rom 1…3ˆ growth in 201’‰ despite economic headwinds… ‚ost maŠor lines 5% Real premium growth contributed‰ but liability and property premiums were particularly strong‰ supported by select rate increases‰ as were ™‘ premiums… ‚otor premiums grew slower than 4% the total but aster than in 201’‰ as reorms in ¢ntario continued to weigh… 3% ‹nderwriting proits o —anadian nonŽlie insurers were supported by accelerating 2% premium growth and lac o any maŠor catastrophe activity… —oupled with a moderate investment result‰ industry ˜¢E improved to 11…’ˆ rom 10…6ˆ in 201’… 1% 0% rowth o ‹„ nonŽlie premiums is expected to slow slightly in 2016 and 201ƒ in the ace o ongoing pricing pressures… ˜ates are expected to weaen in most commercial –1% lines and even become negative or several lines… n improving economy and rising –2% inlation will liely reduce the eect o reserves releases and possibly turn to reserve –3% strengthening in 201ƒ… ˜¢E is expected to continue to all due to sotening rates and LifeNon-life the low interest rate environment‰ and assuming normal catastrophe activity… €remium growth in —anada is expected to slow in 2016 relecting the modest Growth rate 2015 economic bacdrop‰ beore slowly picing up in 201ƒ and beyond… ndustry Pre-crisis average growth 2003–2007 proitability will liely also ease slightly… Post-crisis average growth 2009–2014 2’ Swiss Re sigma No 3/2016

Œestern Europe“ lie premiums slow‰ nonŽlie returns to growth Life insurance ”ie premiums in Œestern Europe grew n Œestern Europe‰ growth in lie insurance premiums slowed to 1…3ˆ in 201 rom by 1…3ˆ to ‹„ ƒ billion in 201… …ˆ in 201’… This was largely due to contraction in ermany †–2…ˆ‡‰ where new business ell in both regular †–3ˆ‡ and single premiums †–…ˆ‡… The ‹– lie maret returned to positive growth †£2…’ˆ‡‰ ater two years o premium declines… n particular‰ sales o investment and savings business is growing again… €remiums in ¥rance grew by 2…¡ˆ… n taly growth lattened ater two years o strong growth as sales o endowments slowed… sharp decline †–1ˆ‡ in premium income in €ortugal reversed some o the strong growth o the previous two years… The maret in „pain grew by £3…’ˆ‰ mainly driven by traditional lie and death beneit protection products… ‹nitŽlined business continued to contract… mong the ¦enelux countries‰ the biggest premium decline †–11ˆ‡ was in ”uxembourg where a volatile growth pattern rom the past ew years continued… The conidence crisis in the utch maret because o misŽselling continued or a ourth year running‰ with premiums down …ƒˆ… n ¦elgium‰ lie premiums were down ’…¡ˆ in 201… The Nordic marets grew by …¡ˆ †„weden‡‰ ƒ…6ˆ †¥inland‡‰ and 2…2ˆ †enmar‡… The ˜¢E o a sample seven European lobals2’ decreased to …6ˆ rom ¡…ˆ in 201’ indicating a lower proitability… ˜¢E or a sample o 6 ‹– companies was 20ˆ…2 The nearŽterm outloo or lie insurers is The shortŽterm outloo or the lie industry in Œestern Europe is blea‰ in part due to subdued… the pending ‹– reerendum on E‹ membership… iven that it is the largest maret in Œestern Europe‰ the outcome o the vote could have signiicant implications or the ‹– maret itsel… ‚ore generally‰ the low interest rate environment will continue to constrain demand or lie insurance as well as sector proitability… ¢n the other hand‰ the aging population in Œestern Europe should generate increased demand or protection‰ savings and retirement products in the longer term… Non-life insurance NonŽlie premium growth in Œestern NonŽlie premium growth in Œestern Europe was a moderate 1…ˆ in 201‰ still well Europe gained pace in 201… below the preŽcrisis average‰ but a big improvement on the 0…2ˆ postŽcrisis average… ermany‰ the ‹– and ¥rance recorded premium volume increases o 2…0ˆ‰ 1…ˆ and Western uro‡e ‡reius• 2015 1…ˆ‰ respectively… n ermany‰ motor and property lines registered solid growth‰ Œorld while ™‘ and liability premiums declined in real terms… n the ‹–‰ premium growth ‹„ bn maret share was up again on the bac o rate improvements… The ¥rench maret was mainly ”ie ƒ 3’ˆ driven by household insurance †£3…ˆ‡… ‚otor insurance expanded due to strong NonŽlie ¡ 2ˆ new car registrations but a new consumer protection law †”oi ‘amon‡ which maes switching insurance policies easier‰ intensiied competition… The Nordic marets Real premium growth were mixed… mong the southern E‹ countries‰ growth was strong again in „pain 7% and €ortugal‰ but reece continued to decline †–6…0ˆ‡… n taly premiums ell 2…ƒˆ‰ % driven by a 6…ˆ all in motor liability‰ relecting a all in new car sales… 5% vailable inormation suggests a 1–2 ppt weaening o underwriting proitability in 4% nonŽlie in Œestern Europe in 201… The average combined ratio o the our largest 3% marets †¥rance‰ ermany‰ taly and the ‹–‡ was around ¡¡ˆ… ˜eserve releases 2% continued‰ but at a reduced pace… ‹nderwriting results deteriorated or motor †ermany‰ taly‡ and commercial insurance †¥rance‰ ermany‡‰ and due to loods in 1% the ‹–… NonŽlie premium growth in Œestern Europe will remain subdued in light o 0% the moderate economic recovery… ‹nderwriting proitability is expected to LifeNon-life deteriorate as a result o soter rates in commercial lines and motor insurance‰ while Growth rate 2015 claims growth will remain moderate… €roitability will remain under pressure due to stillŽlow investment yields… Pre-crisis average growth 2003–2007 Post-crisis average growth 2009–2014 24 llian§‰ ® ‰ —N€‰ enerali‰ „T¢˜E¦˜ N „ ‰ „wiss ”ie and ¹urich… 25 viva‰ ”egal ™ eneral‰ ¢ld ‚utual‰ €rudential †‹–‡‰ „t… •ames €lace‰ and „tandard ”ie… Swiss Re sigma No 3/2016 2

erging regions continue to gain ar„et s‚are dvanced sia“ steady expansion in lie and nonŽlie Life insurance ”ie premiums grew by ’…2ˆ in the ”ie insurance premiums in advanced sia grew by ’…2ˆ in 201‰ ater a 3…3ˆŽgain advanced sian marets in 201… in the previous year… The improvement was driven by acceleration in •apan‰ with premium growth up 2…ˆ rom 1…3ˆ in 201’… This more than compensated or a slowdown in „ingapore to a still solid ¡…ˆ… †201’“ 1’ˆ‡ The slowdown was mostly due to slower sales o single premium lined policies‰ but the maret continued to beneit rom increased transparency and the lower distribution costs resulting rom the irect €urchase nsurance initiative… ‚eanwhile‰ sales remained robust and stable in ‘ong –ong‰ „outh –orea and Taiwan… n •apan‰ improved sales o traditional individual lie products helped oset sluggish demand or annuity products… ‘ong –ong has continued to beneit rom new business sales to visitors rom mainland —hina‰ which accounted or 2’ˆ o total new premiums rom individual lie savings business in 201… n Taiwan‰ there was a recovery in individual annuity sales and in „outh –orea‰ robust sales o protection products underpinned overall premium growth… ”ow interest rates have again raised €rolonged low interest rates has put pressure on lie insurers’ investment returns and concerns about negative spreads … proitability… To counter low returns at home‰ •apanese lie insurers have increased holding o oreign securities… t the same time‰ insurers have sought to lower operational expenses‰ particularly in •apan‰ „outh –orea and Taiwan where insurers ace deepening negative interest rate spreads †maret interest rates are lower than the guaranteed interest rates o policies‡… … and also about insurers’ ability to oer The nearŽterm growth outloo or lie insurance in advanced sia remains uncertain‰ attractive returns to consumers… as low interest rates continue to threaten insurers’ ability to oer attractive returns… This is the case in „outh –orea and Taiwan‰ and even more so in •apan where the central ban has adopted a negative interest rate regime… n ‘ong –ong‰ tightening rules on overseas payments through credit cards‰ and regulator concerns in mainland —hina about currency and claims riss o mainland —hinese purchasing insurance in ‘ong –ong‰ could constrain insurance sales to —hina visitors… Non-life insurance NonŽlie premium growth was stable in NonŽlie premium growth in advanced sia was stronger in 201 than in 201’ 201‰ but proitability was weaer… †£’…1ˆ and £3…’ˆ‰ respectively‡… n •apan‰ premiums rose 3…1ˆ †201’“ 3…¡ˆ‡ rom strong demand or ire cover ahead o rate hies and product revisions in ¢ctober ’d anced ’sia ‡reius• 2015 201… t the same time‰ rate increases pushed motor premiums higher while Œorld personal accident business ell… „tronger growth in ™‘ underpinned a recovery in ‹„ bn maret share ‘ong –ong‰ while in „ingapore growth derived support rom robust expansion in the ”ie ƒ¡ 23ˆ health‰ ire and marine lines… €remium growth in Taiwan was airly broadŽbased NonŽlie 1¡’ 10ˆ across business lines while –orea’s nonŽlie sector beneitted rom rate hies in the motor and health segments… €roitability is estimated to have deteriorated in the Real premium growth advanced sian marets… ‘igher loss ratios were reported in most marets with the 5% exception o „ingapore‰ but there proitability was undermined by higher expenses 4% and low investment returns… n •apan‰ proitability was aected by higher losses rom 3% natural catastrophes in 201‰ including the Typhoons oni and Etau… —ombined insured losses rom the two events are estimated at ‹„ 1… billion… 2% 1% Œeaening economic growth will remain a ey challenge or the nonŽlie sector in 0% advanced sia… The boost rom motor premium rates will begin to ade in 2016‰ while motor vehicles sales liely remain wea… ¢n the other hand‰ growth is expected –1% to remain strong in ™‘‰ partly due to increasing awareness and also product reŽ LifeNon-life pricing‰ or example in „outh –orea… Growth rate 2015 Pre-crisis average growth 2003–2007 Post-crisis average growth 2009–2014 26 Swiss Re sigma No 3/2016

¢ceania“ contracting lie and stable nonŽlie Life insurance ”ie premium growth in ¢ceania in 201 Total lie premiums in ¢ceania contracted by ƒ…ˆ in 201‰ ater strong growth o was dragged down by poor sales o 2ƒ…ˆ in 201’… The main drag was ustralia‰ where premium income ell …1ˆ due investmentŽlined and disability products to volatility in investmentŽlined products and a poor perormance o disability and in ustralia… income protection products… ‹nderwriting perormance improved ater maŠor insurers raised rates on income protection products by a urther –10ˆ ater an aggressive repricing in 201’… ustralian lie insurers’ net ater tax proit rose 10ˆ in 201 and the industry’s capital base remains strong… n New ¹ealand‰ lie premiums grew by 1…ˆ in 201 †201’“ £’…ˆ‡… n increase in sales o trauma insurance and income protectionŽtype products was partly oset by a continued decline in sales o whole lie‰ endowment and unbundled traditional products… The lie sector is expected to resume The lie sector in ¢ceania is expected to return to growth in 2016… n ustralia‰ an moderate premium growth in 2016… improving economy will liely lend support‰ but the unemployment rate remains high and strained household budgets could weigh on insurance demand… ncreased rates or income protection products should support underwriting proits‰ but worsening claims and lapse rates remain a concern… ‚eanwhile‰ regulations are increasingly ocused on consumer protection‰ which could impact insurance distribution… n •une 201‰ the ustralian government gave support to the maŠority o the ¥inancial „ystem n«uiry’s recommendations‰ including restricting upront insurance commissions to agents/advisors… The New ¹ealand government is also reviewing the ¥inancial dvisers ct and the ¥inancial „ervice €roviders ct‰ to either ban or cap commissions or insurance broers and advisers… Non-life insurance NonŽlie premiums grew steadily in NonŽlie insurance premium growth in ¢ceania was lat in 201‰ ater 1…1ˆ growth in personal lines but were sluggish in 201’… n ustralia‰ premiums grew 0…ˆ †201’“ £1…3ˆ‡… There was wea growth in commercial lines… commercial lines overall… n particular‰ liability lines were sluggish and property –ceania ‡reius• 2015 premiums declined… n comparison‰ maŠor personal lines – including property and Œorld motor – recorded moderate growth… ¢verall‰ gross claims incurred rose in 201‰ due ‹„ bn maret share mainly to losses rom a number o natural catastrophe events including —yclone ”ie ’ 1…ˆ ‚arcia‰ heavy storms in New „outh Œales and „outh East ·ueensland‰ hailstorms in NonŽlie 3 1…ƒˆ „ydney and bushires in „outh ustralia… Total claims rom these events were ‹ 2…2 billion †as o November 201‡‰ according to estimates by the nsurance —ouncil 4% Real premium growth o ustralia… The overall loss ratio rose to 6¡…2ˆ in 201 rom 63…2ˆ in 201’… longside higher losses rom natural catastrophes and weaer investment results‰ 2% ustralia’s nonŽlie insurers reported a ’3ˆ drop in aterŽtax net proits… NonŽlie 0% direct insurers’ solvency ratio declined slightly in 201‰ but was still strong… n New –2% ¹ealand‰ nonŽlie insurance premiums are estimated to have declined by 1…2ˆ †201’“ £0…2ˆ‡‰ relecting a wea economic bacdrop… ¦y line o business‰ property –4% premiums contracted due to ierce price competition‰ motor was steady‰ and liability –% lines were mixed… The loss ratio is estimated to have improved‰ relecting benign –% natural catastrophe losses and lower liabilities claims… –10% NonŽlie insurers still ace pricing pressures‰ and premium growth in ¢ceania is LifeNon-life expected to remain low in 2016… n addition‰ an expansive range o regulatory Growth rate 2015 changes present maŠor challenges… ¥or example‰ the ustralian government Pre-crisis average growth 2003–2007 established the Northern ustralia nsurance €remiums Tasorce to explore options Post-crisis average growth 2009–2014 to reduce home‰ contents and strata insurance †general insurance or common and/ or shared property‡ premium rates… n New ¹ealand‰ the government has proposed increasing the limit o building cover by the Earth«uae —ommission †E·—‡… s E·— insures property on a irstŽloss basis‰ the rise in insured limits could crowd out private nonŽlie insurers oering excess covers… Swiss Re sigma No 3/2016 2ƒ

Emerging marets continue to gain global share nsurance maret expansion advances urther €remium growth in the emerging Total insurance premiums written in the emerging marets in 201 rose by ¡…ˆ to marets remained strong in 201… ‹„ 0 billion‰ and premium growth continued to outpace € growth… The global share o emerging maret premiums grew by 1…2 ppt to 1…ƒˆ‰ helped by exchange rate weaness in the maŠor advanced economies… „ince 2006‰ insurance sector growth in the emerging marets has outpaced economic growth by a actor o more than 1…… Excluding —hina‰ however‰ this actor was signiicantly lower as insurance maret growth was only 1…1 times higher than economic growth… Life insurance ”ie insurance penetration continued to ”ie premiums in the emerging marets overall grew by 12ˆ in 201‰ well above increase in 201… economic growth o 3…ˆ… €remium growth was stronger than economic growth in ’1 o the 1 marets or which data are available… n ¥igure 20‰ the blue dots above the line represent those marets where premium growth exceeded € growth last year‰ meaning an increase in insurance penetration… Figure 20 25€ ”ie and nonŽlie premium growth versus € growth in emerging marets‰ 201 15€ 5 rail 1 0 5€ h 2 0€ Russia wt o r 5€ eneuela cuaor emium g 15€ eal pr R 25€ Ukraine 5€ 1€ ‚€ € 0€ € ‚€ Real GDP growth 2015 Life insurance Non-life insurance GDP growth eual to premium growth „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Non-life €remium growth in the nonŽlie sector NonŽlie premiums in the emerging marets overall grew by ƒ…ˆ in 201‰ still solid was slower than in lie… despite a wea economic environment… t the country level‰ insurance penetration increased in 3’ o the 2 marets or which 201 data are available… ‰nsurance ‡enetration and densit€ €er capita spending on insurance in the verage per capita spending on insurance in emerging marets remained little emerging marets was unchanged in changed at ‹„ 13 in 201‰ o which ‹„ ƒ1 went to lie insurance and ‹„ 6’ 201‰ but penetration increased… to nonŽlie… The average insurance penetration in emerging marets increased to 2…¡ˆ last year rom 2…ƒˆ in 201’… 2 Swiss Re sigma No 3/2016

Figure 21 nsurance density and penetration in emerging marets‰ 201 Premiums in USD 0 500 1000 1500 2000 2500 Macao Qatar United Arab Emirates Slovenia Trinidad and Tobago South Africa Chile Czech Republic Mauritius Bahrain Malaysia Argentina Slovakia Namibia Poland Uruguay Panama Brazil Thailand Saudi Arabia Hungary Croatia PR China Kuwait Lebanon Oman Venezuela Costa Rica Mexico Colombia Bulgaria Turkey Ecuador Average Russia Peru Romania Serbia Jordan Iran Morocco Dominican Republic Tunisia Kazakhstan Indonesia Philippines India Guatemala Sri Lanka Kenya Angola Vietnam Algeria Ukraine Egypt Pakistan Bangladesh Nigeria 0% 3% 6% 9% 12% 15% Premiums as a % of GDP Non-life premiums per capita Life premiums per capita Total insurance penetration (lower axis) „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Swiss Re sigma No 3/2016 2¡