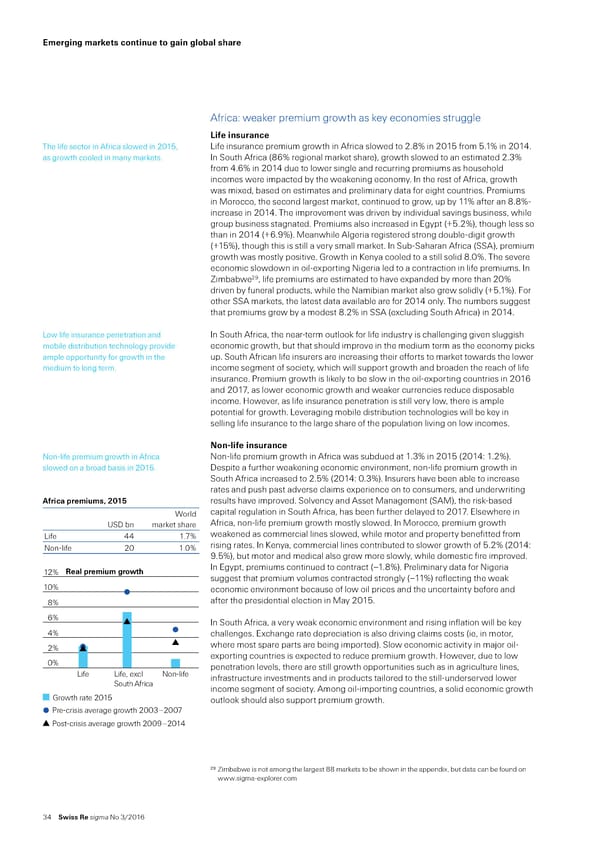

erging ar„ets continue to gain gloƒal s‚are rica“ weaer premium growth as ey economies struggle Life insurance The lie sector in rica slowed in 201‰ ”ie insurance premium growth in rica slowed to 2…ˆ in 201 rom …1ˆ in 201’… as growth cooled in many marets… n „outh rica †6ˆ regional maret share‡‰ growth slowed to an estimated 2…3ˆ rom ’…6ˆ in 201’ due to lower single and recurring premiums as household incomes were impacted by the weaening economy… n the rest o rica‰ growth was mixed‰ based on estimates and preliminary data or eight countries… €remiums in ‚orocco‰ the second largest maret‰ continued to grow‰ up by 11ˆ ater an …ˆŽ increase in 201’… The improvement was driven by individual savings business‰ while group business stagnated… €remiums also increased in Egypt †£…2ˆ‡‰ though less so than in 201’ †£6…¡ˆ‡… ‚eanwhile lgeria registered strong doubleŽdigit growth †£1ˆ‡‰ though this is still a very small maret… n „ubŽ„aharan rica †„„ ‡‰ premium growth was mostly positive… rowth in –enya cooled to a still solid …0ˆ… The severe economic slowdown in oilŽexporting Nigeria led to a contraction in lie premiums… n 2¡ ¹imbabwe ‰ lie premiums are estimated to have expanded by more than 20ˆ driven by uneral products‰ while the Namibian maret also grew solidly †£…1ˆ‡… ¥or other „„ marets‰ the latest data available are or 201’ only… The numbers suggest that premiums grew by a modest …2ˆ in „„ †excluding „outh rica‡ in 201’… ”ow lie insurance penetration and n „outh rica‰ the nearŽterm outloo or lie industry is challenging given sluggish mobile distribution technology provide economic growth‰ but that should improve in the medium term as the economy pics ample opportunity or growth in the up… „outh rican lie insurers are increasing their eorts to maret towards the lower medium to long term… income segment o society‰ which will support growth and broaden the reach o lie insurance… €remium growth is liely to be slow in the oilŽexporting countries in 2016 and 201ƒ‰ as lower economic growth and weaer currencies reduce disposable income… ‘owever‰ as lie insurance penetration is still very low‰ there is ample potential or growth… ”everaging mobile distribution technologies will be ey in selling lie insurance to the large share o the population living on low incomes… Non-life insurance NonŽlie premium growth in rica NonŽlie premium growth in rica was subdued at 1…3ˆ in 201 †201’“ 1…2ˆ‡… slowed on a broad basis in 201… espite a urther weaening economic environment‰ nonŽlie premium growth in „outh rica increased to 2…ˆ †201’“ 0…3ˆ‡… nsurers have been able to increase rates and push past adverse claims experience on to consumers‰ and underwriting ’frica ‡reius• 2015 results have improved… „olvency and sset ‚anagement †„ ‚‡‰ the risŽbased Œorld capital regulation in „outh rica‰ has been urther delayed to 201ƒ… Elsewhere in ‹„ bn maret share rica‰ nonŽlie premium growth mostly slowed… n ‚orocco‰ premium growth ”ie ’’ 1…ƒˆ weaened as commercial lines slowed‰ while motor and property beneitted rom NonŽlie 20 1…0ˆ rising rates… n –enya‰ commercial lines contributed to slower growth o …2ˆ †201’“ ¡…ˆ‡‰ but motor and medical also grew more slowly‰ while domestic ire improved… 12 Real premium growth n Egypt‰ premiums continued to contract †–1…ˆ‡… €reliminary data or Nigeria suggest that premium volumes contracted strongly †–11ˆ‡ relecting the wea 10 economic environment because o low oil prices and the uncertainty beore and ater the presidential election in ‚ay 201… n „outh rica‰ a very wea economic environment and rising inlation will be ey challenges… Exchange rate depreciation is also driving claims costs †ie‰ in motor‰ 2 where most spare parts are being imported‡… „low economic activity in maŠor oilŽ 0 exporting countries is expected to reduce premium growth… ‘owever‰ due to low Life Life, excl Non-life penetration levels‰ there are still growth opportunities such as in agriculture lines‰ South Africa inrastructure investments and in products tailored to the stillŽunderserved lower income segment o society… mong oilŽimporting countries‰ a solid economic growth Growth rate 2015 outloo should also support premium growth… Pre-crisis average growth 2003–200 Post-crisis average growth 200–201 29 ¹imbabwe is not among the largest marets to be shown in the appendix‰ but data can be ound on www…sigmaŽexplorer…com 3’ Swiss Re sigma No 3/2016

World Insurance in 2015 Page 42 Page 44

World Insurance in 2015 Page 42 Page 44