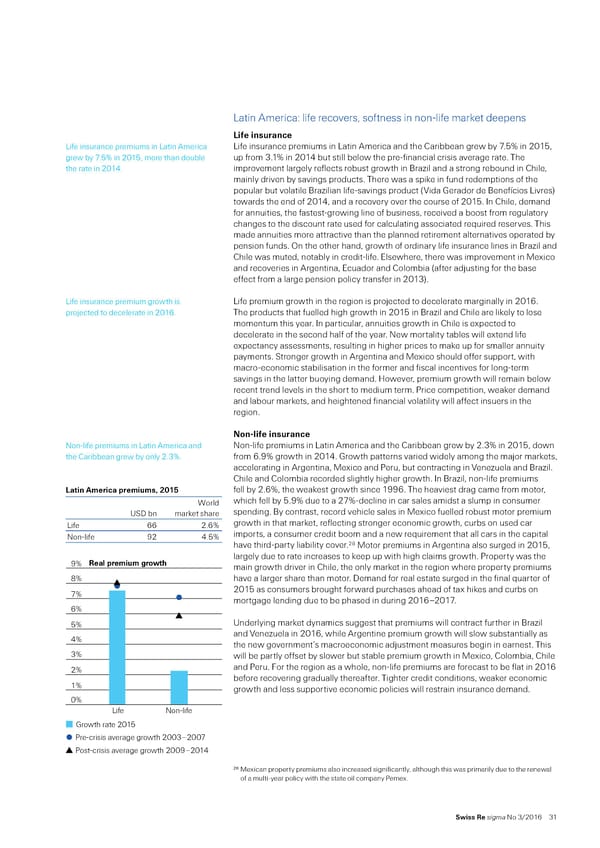

”atin merica“ lie recovers‰ sotness in nonŽlie maret deepens Life insurance ”ie insurance premiums in ”atin merica ”ie insurance premiums in ”atin merica and the —aribbean grew by ƒ…ˆ in 201‰ grew by ƒ…ˆ in 201‰ more than double up rom 3…1ˆ in 201’ but still below the preŽinancial crisis average rate… The the rate in 201’… improvement largely relects robust growth in ¦ra§il and a strong rebound in —hile‰ mainly driven by savings products… There was a spie in und redemptions o the popular but volatile ¦ra§ilian lieŽsavings product †¨ida erador de ¦eneícios ”ivres‡ towards the end o 201’‰ and a recovery over the course o 201… n —hile‰ demand or annuities‰ the astestŽgrowing line o business‰ received a boost rom regulatory changes to the discount rate used or calculating associated re«uired reserves… This made annuities more attractive than the planned retirement alternatives operated by pension unds… ¢n the other hand‰ growth o ordinary lie insurance lines in ¦ra§il and —hile was muted‰ notably in creditŽlie… Elsewhere‰ there was improvement in ‚exico and recoveries in rgentina‰ Ecuador and —olombia †ater adŠusting or the base eect rom a large pension policy transer in 2013‡… ”ie insurance premium growth is ”ie premium growth in the region is proŠected to decelerate marginally in 2016… proŠected to decelerate in 2016… The products that uelled high growth in 201 in ¦ra§il and —hile are liely to lose momentum this year… n particular‰ annuities growth in —hile is expected to decelerate in the second hal o the year… New mortality tables will extend lie expectancy assessments‰ resulting in higher prices to mae up or smaller annuity payments… „tronger growth in rgentina and ‚exico should oer support‰ with macroŽeconomic stabilisation in the ormer and iscal incentives or longŽterm savings in the latter buoying demand… ‘owever‰ premium growth will remain below recent trend levels in the short to medium term… €rice competition‰ weaer demand and labour marets‰ and heightened inancial volatility will aect insuers in the region… Non-life insurance NonŽlie premiums in ”atin merica and NonŽlie premiums in ”atin merica and the —aribbean grew by 2…3ˆ in 201‰ down the —aribbean grew by only 2…3ˆ… rom 6…¡ˆ growth in 201’… rowth patterns varied widely among the maŠor marets‰ accelerating in rgentina‰ ‚exico and €eru‰ but contracting in ¨ene§uela and ¦ra§il… —hile and —olombia recorded slightly higher growth… n ¦ra§il‰ nonŽlie premiums Latin ’erica ‡reius• 2015 ell by 2…6ˆ‰ the weaest growth since 1¡¡6… The heaviest drag came rom motor‰ Œorld which ell by …¡ˆ due to a 2ƒˆŽdecline in car sales amidst a slump in consumer ‹„ bn maret share spending… ¦y contrast‰ record vehicle sales in ‚exico uelled robust motor premium ”ie 66 2…6ˆ growth in that maret‰ relecting stronger economic growth‰ curbs on used car NonŽlie ¡2 ’…ˆ imports‰ a consumer credit boom and a new re«uirement that all cars in the capital have thirdŽparty liability cover…26 ‚otor premiums in rgentina also surged in 201‰ Real premium growth largely due to rate increases to eep up with high claims growth… €roperty was the 9% main growth driver in —hile‰ the only maret in the region where property premiums 8% have a larger share than motor… emand or real estate surged in the inal «uarter o 7% 201 as consumers brought orward purchases ahead o tax hies and curbs on mortgage lending due to be phased in during 2016–201ƒ… 6% 5% ‹nderlying maret dynamics suggest that premiums will contract urther in ¦ra§il 4% and ¨ene§uela in 2016‰ while rgentine premium growth will slow substantially as the new government’s macroeconomic adŠustment measures begin in earnest… This 3% will be partly oset by slower but stable premium growth in ‚exico‰ —olombia‰ —hile 2% and €eru… ¥or the region as a whole‰ nonŽlie premiums are orecast to be lat in 2016 beore recovering gradually thereater… Tighter credit conditions‰ weaer economic 1% growth and less supportive economic policies will restrain insurance demand… 0% LifeNon-life Growth rate 2015 Pre-crisis averae rowth 2003–2007 Post-crisis averae rowth 2009–2014 26 ‚exican property premiums also increased signiicantly‰ although this was primarily due to the renewal o a multiŽyear policy with the state oil company €emex… Swiss Re sigma No 3/2016 31

World Insurance in 2015 Page 39 Page 41

World Insurance in 2015 Page 39 Page 41