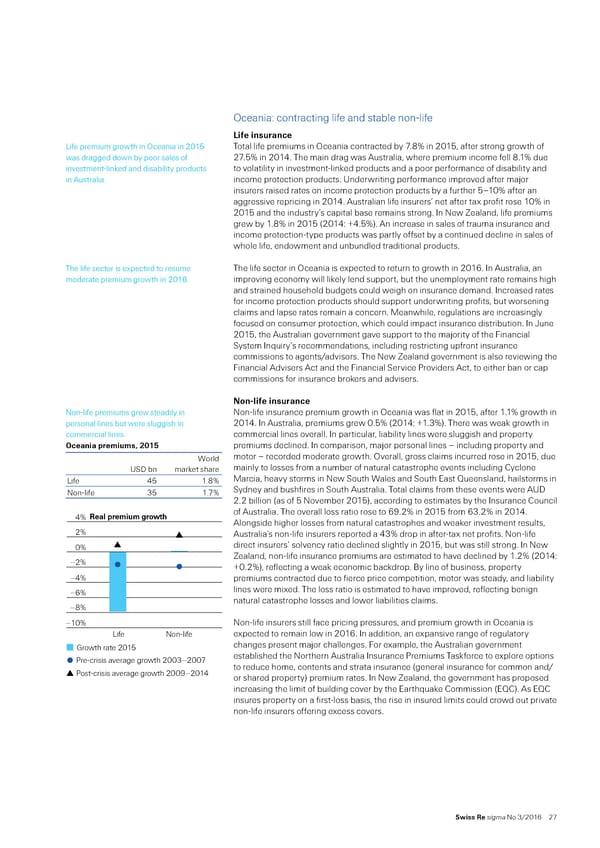

¢ceania“ contracting lie and stable nonŽlie Life insurance ”ie premium growth in ¢ceania in 201 Total lie premiums in ¢ceania contracted by ƒ…ˆ in 201‰ ater strong growth o was dragged down by poor sales o 2ƒ…ˆ in 201’… The main drag was ustralia‰ where premium income ell …1ˆ due investmentŽlined and disability products to volatility in investmentŽlined products and a poor perormance o disability and in ustralia… income protection products… ‹nderwriting perormance improved ater maŠor insurers raised rates on income protection products by a urther –10ˆ ater an aggressive repricing in 201’… ustralian lie insurers’ net ater tax proit rose 10ˆ in 201 and the industry’s capital base remains strong… n New ¹ealand‰ lie premiums grew by 1…ˆ in 201 †201’“ £’…ˆ‡… n increase in sales o trauma insurance and income protectionŽtype products was partly oset by a continued decline in sales o whole lie‰ endowment and unbundled traditional products… The lie sector is expected to resume The lie sector in ¢ceania is expected to return to growth in 2016… n ustralia‰ an moderate premium growth in 2016… improving economy will liely lend support‰ but the unemployment rate remains high and strained household budgets could weigh on insurance demand… ncreased rates or income protection products should support underwriting proits‰ but worsening claims and lapse rates remain a concern… ‚eanwhile‰ regulations are increasingly ocused on consumer protection‰ which could impact insurance distribution… n •une 201‰ the ustralian government gave support to the maŠority o the ¥inancial „ystem n«uiry’s recommendations‰ including restricting upront insurance commissions to agents/advisors… The New ¹ealand government is also reviewing the ¥inancial dvisers ct and the ¥inancial „ervice €roviders ct‰ to either ban or cap commissions or insurance broers and advisers… Non-life insurance NonŽlie premiums grew steadily in NonŽlie insurance premium growth in ¢ceania was lat in 201‰ ater 1…1ˆ growth in personal lines but were sluggish in 201’… n ustralia‰ premiums grew 0…ˆ †201’“ £1…3ˆ‡… There was wea growth in commercial lines… commercial lines overall… n particular‰ liability lines were sluggish and property –ceania ‡reius• 2015 premiums declined… n comparison‰ maŠor personal lines – including property and Œorld motor – recorded moderate growth… ¢verall‰ gross claims incurred rose in 201‰ due ‹„ bn maret share mainly to losses rom a number o natural catastrophe events including —yclone ”ie ’ 1…ˆ ‚arcia‰ heavy storms in New „outh Œales and „outh East ·ueensland‰ hailstorms in NonŽlie 3 1…ƒˆ „ydney and bushires in „outh ustralia… Total claims rom these events were ‹ 2…2 billion †as o November 201‡‰ according to estimates by the nsurance —ouncil 4% Real premium growth o ustralia… The overall loss ratio rose to 6¡…2ˆ in 201 rom 63…2ˆ in 201’… longside higher losses rom natural catastrophes and weaer investment results‰ 2% ustralia’s nonŽlie insurers reported a ’3ˆ drop in aterŽtax net proits… NonŽlie 0% direct insurers’ solvency ratio declined slightly in 201‰ but was still strong… n New –2% ¹ealand‰ nonŽlie insurance premiums are estimated to have declined by 1…2ˆ †201’“ £0…2ˆ‡‰ relecting a wea economic bacdrop… ¦y line o business‰ property –4% premiums contracted due to ierce price competition‰ motor was steady‰ and liability –% lines were mixed… The loss ratio is estimated to have improved‰ relecting benign –% natural catastrophe losses and lower liabilities claims… –10% NonŽlie insurers still ace pricing pressures‰ and premium growth in ¢ceania is LifeNon-life expected to remain low in 2016… n addition‰ an expansive range o regulatory Growth rate 2015 changes present maŠor challenges… ¥or example‰ the ustralian government Pre-crisis average growth 2003–2007 established the Northern ustralia nsurance €remiums Tasorce to explore options Post-crisis average growth 2009–2014 to reduce home‰ contents and strata insurance †general insurance or common and/ or shared property‡ premium rates… n New ¹ealand‰ the government has proposed increasing the limit o building cover by the Earth«uae —ommission †E·—‡… s E·— insures property on a irstŽloss basis‰ the rise in insured limits could crowd out private nonŽlie insurers oering excess covers… Swiss Re sigma No 3/2016 2ƒ

World Insurance in 2015 Page 34 Page 36

World Insurance in 2015 Page 34 Page 36