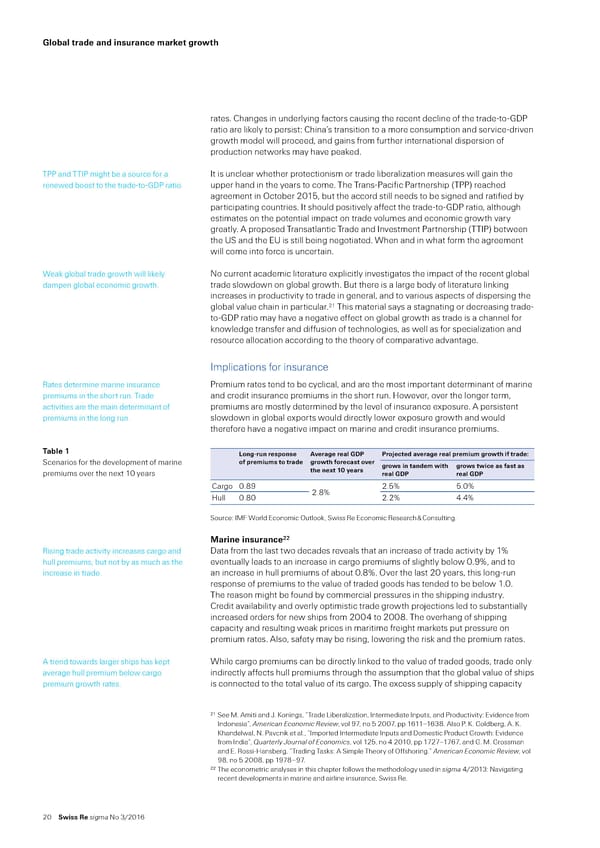

Žloƒal trade and insurance ar„et growt‚ rates… —hanges in underlying actors causing the recent decline o the tradeŽtoŽ€ ratio are liely to persist“ —hina’s transition to a more consumption and serviceŽdriven growth model will proceed‰ and gains rom urther international dispersion o production networs may have peaed… T€€ and TT€ might be a source or a t is unclear whether protectionism or trade liberali§ation measures will gain the renewed boost to the tradeŽtoŽ€ ratio… upper hand in the years to come… The TransŽ€aciic €artnership †T€€‡ reached agreement in ¢ctober 201‰ but the accord still needs to be signed and ratiied by participating countries… t should positively aect the tradeŽtoŽ€ ratio‰ although estimates on the potential impact on trade volumes and economic growth vary greatly… proposed Transatlantic Trade and nvestment €artnership †TT€‡ between the ‹„ and the E‹ is still being negotiated… Œhen and in what orm the agreement will come into orce is uncertain… Œea global trade growth will liely No current academic literature explicitly investigates the impact o the recent global dampen global economic growth… trade slowdown on global growth… ¦ut there is a large body o literature lining increases in productivity to trade in general‰ and to various aspects o dispersing the global value chain in particular…21 This material says a stagnating or decreasing tradeŽ toŽ€ ratio may have a negative eect on global growth as trade is a channel or nowledge transer and diusion o technologies‰ as well as or speciali§ation and resource allocation according to the theory o comparative advantage… mplications or insurance ˜ates determine marine insurance €remium rates tend to be cyclical‰ and are the most important determinant o marine premiums in the short run… Trade and credit insurance premiums in the short run… ‘owever‰ over the longer term‰ activities are the main determinant o premiums are mostly determined by the level o insurance exposure… persistent premiums in the long run… slowdown in global exports would directly lower exposure growth and would thereore have a negative impact on marine and credit insurance premiums… Taƒle 1 Long-run res‡onse ’ erage real Ž“† †ro”ected a erage real ‡reiu growt‚ if trade: „cenarios or the development o marine of ‡reius to trade growt‚ forecast o er grows in tande wit‚ grows twice as fast as premiums over the next 10 years t‚e net 10 €ears real Ž“† real Ž“† —argo 0…¡ 2…ˆ 2…ˆ …0ˆ ‘ull 0…0 2…2ˆ ’…’ˆ „ource“ ‚¥ Œorld Economic ¢utloo‰ „wiss ˜e Economic ˜esearch ™ —onsulting… 22 ‘arine insurance ˜ising trade activity increases cargo and ata rom the last two decades reveals that an increase o trade activity by 1ˆ hull premiums‰ but not by as much as the eventually leads to an increase in cargo premiums o slightly below 0…¡ˆ‰ and to increase in trade… an increase in hull premiums o about 0…ˆ… ¢ver the last 20 years‰ this longŽrun response o premiums to the value o traded goods has tended to be below 1…0… The reason might be ound by commercial pressures in the shipping industry… —redit availability and overly optimistic trade growth proŠections led to substantially increased orders or new ships rom 200’ to 200… The overhang o shipping capacity and resulting wea prices in maritime reight marets put pressure on premium rates… lso‰ saety may be rising‰ lowering the ris and the premium rates… trend towards larger ships has ept Œhile cargo premiums can be directly lined to the value o traded goods‰ trade only average hull premium below cargo indirectly aects hull premiums through the assumption that the global value o ships premium growth rates… is connected to the total value o its cargo… The excess supply o shipping capacity 21 „ee ‚… miti and •… –onings‰ “Trade ”iberali§ation‰ ntermediate nputs‰ and €roductivity“ Evidence rom ndonesia”‰ merican ‚conomic Review‰ vol ¡ƒ‰ no 200ƒ‰ pp 1611–163… lso €… –… oldberg‰ … –… –handelwal‰ N… €avcni et al…‰ “mported ntermediate nputs and omestic €roduct rowth“ Evidence rom ndia”‰ …uarterly †ournal of ‚conomics‰ vol 12‰ no ’ 2010‰ pp 1ƒ2ƒ–1ƒ6ƒ‰ and … ‚… rossman and E… ˜ossiŽ‘ansberg‰ “Trading Tass“ „imple Theory o ¢shoring…” merican ‚conomic Review‰ vol ¡‰ no 200‰ pp 1¡ƒ–¡ƒ… 22 The econometric analyses in this chapter ollows the methodology used in sigma ’/2013“ Navigating recent developments in marine and airline insurance‰ „wiss ˜e… 20 Swiss Re sigma No 3/2016

World Insurance in 2015 Page 26 Page 28

World Insurance in 2015 Page 26 Page 28