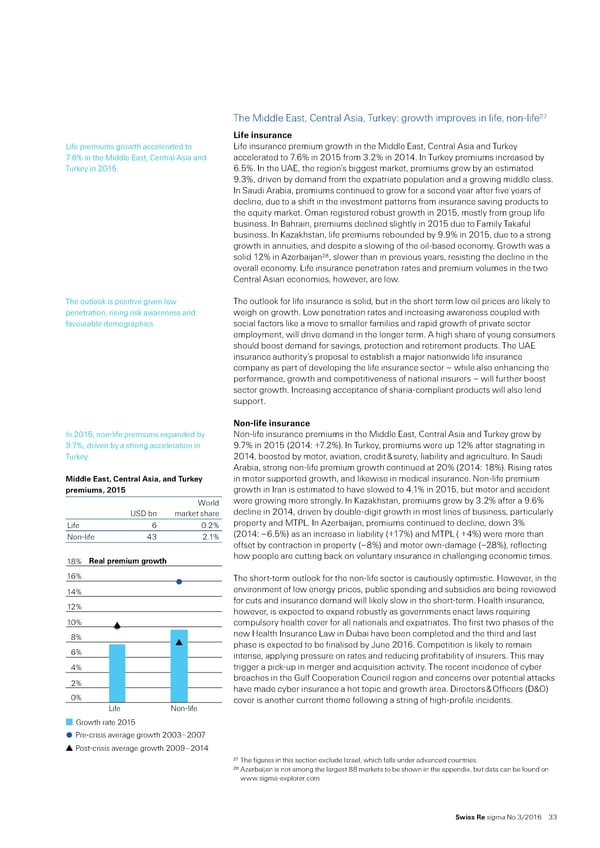

2ƒ The ‚iddle East‰ —entral sia‰ Turey“ growth improves in lie‰ nonŽlie Life insurance ”ie premiums growth accelerated to ”ie insurance premium growth in the ‚iddle East‰ —entral sia and Turey ƒ…6ˆ in the ‚iddle East‰ —entral sia and accelerated to ƒ…6ˆ in 201 rom 3…2ˆ in 201’… n Turey premiums increased by Turey in 201… 6…ˆ… n the ‹ E‰ the region’s biggest maret‰ premiums grew by an estimated ¡…3ˆ‰ driven by demand rom the expatriate population and a growing middle class… n „audi rabia‰ premiums continued to grow or a second year ater ive years o decline‰ due to a shit in the investment patterns rom insurance saving products to the e«uity maret… ¢man registered robust growth in 201‰ mostly rom group lie business… n ¦ahrain‰ premiums declined slightly in 201 due to ¥amily Taaul business… n –a§ahstan‰ lie premiums rebounded by ¡…¡ˆ in 201‰ due to a strong growth in annuities‰ and despite a slowing o the oilŽbased economy… rowth was a 2 solid 12ˆ in §erbaiŠan ‰ slower than in previous years‰ resisting the decline in the overall economy… ”ie insurance penetration rates and premium volumes in the two —entral sian economies‰ however‰ are low… The outloo is positive given low The outloo or lie insurance is solid‰ but in the short term low oil prices are liely to penetration‰ rising ris awareness and weigh on growth… ”ow penetration rates and increasing awareness coupled with avourable demographics… social actors lie a move to smaller amilies and rapid growth o private sector employment‰ will drive demand in the longer term… high share o young consumers should boost demand or savings‰ protection and retirement products… The ‹ E insurance authority’s proposal to establish a maŠor nationwide lie insurance company as part o developing the lie insurance sector – while also enhancing the perormance‰ growth and competitiveness o national insurers – will urther boost sector growth… ncreasing acceptance o shariaŽcompliant products will also lend support… Non-life insurance n 201‰ nonŽlie premiums expanded by NonŽlie insurance premiums in the ‚iddle East‰ —entral sia and Turey grew by ¡…ƒˆ‰ driven by a strong acceleration in ¡…ƒˆ in 201 †201’“ £ƒ…2ˆ‡… n Turey‰ premiums were up 12ˆ ater stagnating in Turey… 201’‰ boosted by motor‰ aviation‰ credit ™ surety‰ liability and agriculture… n „audi rabia‰ strong nonŽlie premium growth continued at 20ˆ †201’“ 1ˆ‡… ˜ising rates ‘iddle ast• Œentral ’sia• and Tur„e€ in motor supported growth‰ and liewise in medical insurance… NonŽlie premium ‡reius• 2015 growth in ran is estimated to have slowed to ’…1ˆ in 201‰ but motor and accident Œorld were growing more strongly… n –a§ahstan‰ premiums grew by 3…2ˆ ater a ¡…6ˆ ‹„ bn maret share decline in 201’‰ driven by doubleŽdigit growth in most lines o business‰ particularly ”ie 6 0…2ˆ property and ‚T€”… n §erbaiŠan‰ premiums continued to decline‰ down 3ˆ NonŽlie ’3 2…1ˆ †201’“ –6…ˆ‡ as an increase in liability †£1ƒˆ‡ and ‚T€” † £’ˆ‡ were more than oset by contraction in property †–ˆ‡ and motor ownŽdamage †–2ˆ‡‰ relecting 18% Real premium growth how people are cutting bac on voluntary insurance in challenging economic times… 16% The shortŽterm outloo or the nonŽlie sector is cautiously optimistic… ‘owever‰ in the 14% environment o low energy prices‰ public spending and subsidies are being reviewed 12% or cuts and insurance demand will liely slow in the shortŽterm… ‘ealth insurance‰ however‰ is expected to expand robustly as governments enact laws re«uiring 10% compulsory health cover or all nationals and expatriates… The irst two phases o the 8% new ‘ealth nsurance ”aw in ubai have been completed and the third and last phase is expected to be inalised by •une 2016… —ompetition is liely to remain 6% intense‰ applying pressure on rates and reducing proitability o insurers… This may 4% trigger a picŽup in merger and ac«uisition activity… The recent incidence o cyber 2% breaches in the ul —ooperation —ouncil region and concerns over potential attacs have made cyber insurance a hot topic and growth area… irectors ™ ¢icers †™¢‡ 0% cover is another current theme ollowing a string o highŽproile incidents… LifeNon-life Growth rate 2015 Pre-crisis average growth 2003–200 Post-crisis average growth 200–2014 27 The igures in this section exclude srael‰ which alls under advanced countries… 28 §erbaiŠan is not among the largest marets to be shown in the appendix‰ but data can be ound on www…sigmaŽexplorer…com Swiss Re sigma No 3/2016 33

World Insurance in 2015 Page 41 Page 43

World Insurance in 2015 Page 41 Page 43