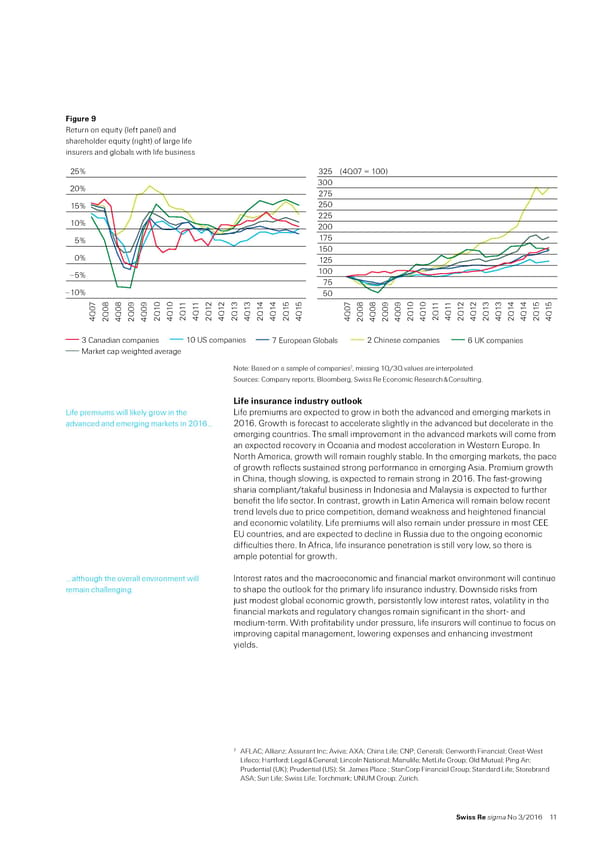

Figure ‹ ˜eturn on e«uity †let panel‡ and shareholder e«uity †right‡ o large lie insurers and globals with lie business 25… 325 (4Q07 = 100) 20… 300 275 15… 250 225 10… 200 5… 175 150 0… 125 –5… 100 75 –10… 50 7 ƒ ƒ ‚ ‚ 0 0 1 1 2 2 3 3 4 4 5 5 7 ƒ ƒ ‚ ‚ 0 0 1 1 2 2 3 3 4 4 5 5 4Q0 2Q0 4Q0 2Q0 4Q0 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 4Q0 2Q0 4Q0 2Q0 4Q0 2Q14Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q1 4Q1 2Q14Q1 3 Canadian companies 10 companies 7 ropean o€as 2 Chinese companies companies Market cap weighted average ƒ Note“ ¦ased on a sample o companies ‰ missing 1·/3· values are interpolated… „ources“ —ompany reports‰ ¦loomberg‰ „wiss ˜e Economic ˜esearch ™ —onsulting… Life insurance industr€ outloo„ ”ie premiums will liely grow in the ”ie premiums are expected to grow in both the advanced and emerging marets in advanced and emerging marets in 2016 … 2016… rowth is orecast to accelerate slightly in the advanced but decelerate in the emerging countries… The small improvement in the advanced marets will come rom an expected recovery in ¢ceania and modest acceleration in Œestern Europe… n North merica‰ growth will remain roughly stable… n the emerging marets‰ the pace o growth relects sustained strong perormance in emerging sia… €remium growth in —hina‰ though slowing‰ is expected to remain strong in 2016… The astŽgrowing sharia compliant/taaul business in ndonesia and ‚alaysia is expected to urther beneit the lie sector… n contrast‰ growth in ”atin merica will remain below recent trend levels due to price competition‰ demand weaness and heightened inancial and economic volatility… ”ie premiums will also remain under pressure in most —EE E‹ countries‰ and are expected to decline in ˜ussia due to the ongoing economic diiculties there… n rica‰ lie insurance penetration is still very low‰ so there is ample potential or growth… … although the overall environment will nterest rates and the macroeconomic and inancial maret environment will continue remain challenging… to shape the outloo or the primary lie insurance industry… ownside riss rom Šust modest global economic growth‰ persistently low interest rates‰ volatility in the inancial marets and regulatory changes remain signiicant in the shortŽ and mediumŽterm… Œith proitability under pressure‰ lie insurers will continue to ocus on improving capital management‰ lowering expenses and enhancing investment yields… 7 ¥” —Ÿ llian§Ÿ ssurant ncŸ vivaŸ ® Ÿ —hina ”ieŸ —N€Ÿ eneraliŸ enworth ¥inancialŸ reatŽŒest ”iecoŸ ‘artordŸ ”egal ™ eneralŸ ”incoln NationalŸ ‚anulieŸ ‚et”ie roupŸ ¢ld ‚utualŸ €ing nŸ €rudential †‹–‡Ÿ €rudential †‹„‡Ÿ „t… •ames €lace Ÿ „tan—orp ¥inancial roupŸ „tandard ”ieŸ „torebrand „ Ÿ „un ”ieŸ „wiss ”ieŸ TorchmarŸ ‹N‹‚ roupŸ ¹urich… Swiss Re sigma No 3/2016 11

World Insurance in 2015 Page 16 Page 18

World Insurance in 2015 Page 16 Page 18