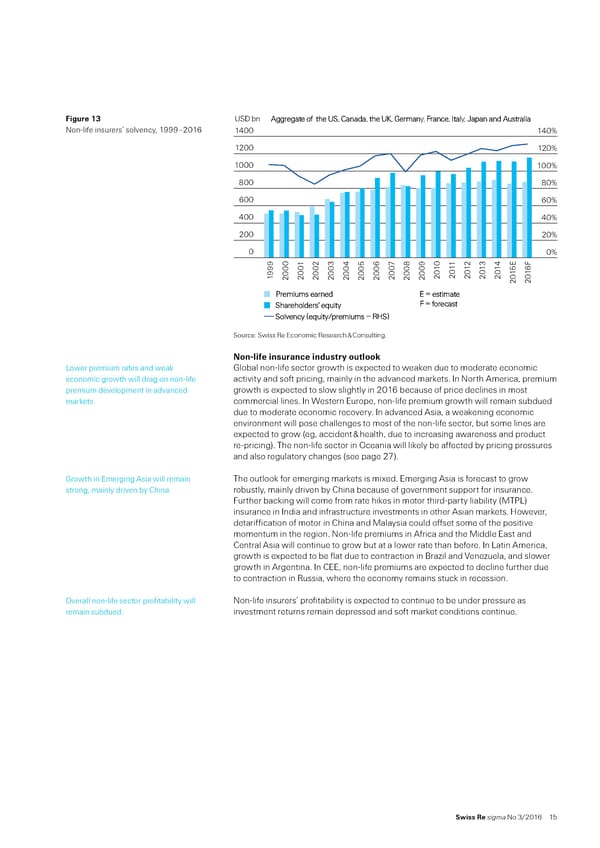

Figure 1 USD bn Aggregate of the US, Canada, the UK, Germany, France, Italy, Japan and Australia NonŽlie insurers’ solvency‰ 1¡¡¡–2016 1400 140% 1200 120% 1000 100% 800 80% 600 60% 400 40% 200 20% 0 0% 01 02 03 04 05 06 07 08 09 10 11 12 13 14 E F 999 000 20 20 20 20 20 15 16 1 2 20 20 20 20 20 20 20 20 20 20 20 remiums earned estimate Shareholders euity F forecast Solency euitypremiums – ‚ƒS„ „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Non-life insurance industr€ outloo„ ”ower premium rates and wea lobal nonŽlie sector growth is expected to weaen due to moderate economic economic growth will drag on nonŽlie activity and sot pricing‰ mainly in the advanced marets… n North merica‰ premium premium development in advanced growth is expected to slow slightly in 2016 because o price declines in most marets… commercial lines… n Œestern Europe‰ nonŽlie premium growth will remain subdued due to moderate economic recovery… n advanced sia‰ a weaening economic environment will pose challenges to most o the nonŽlie sector‰ but some lines are expected to grow †eg‰ accident ™ health‰ due to increasing awareness and product reŽpricing‡… The nonŽlie sector in ¢ceania will liely be aected by pricing pressures and also regulatory changes †see page 2ƒ‡… rowth in Emerging sia will remain The outloo or emerging marets is mixed… Emerging sia is orecast to grow strong‰ mainly driven by —hina… robustly‰ mainly driven by —hina because o government support or insurance… ¥urther bacing will come rom rate hies in motor thirdŽparty liability †‚T€”‡ insurance in ndia and inrastructure investments in other sian marets… ‘owever‰ detariication o motor in —hina and ‚alaysia could oset some o the positive momentum in the region… NonŽlie premiums in rica and the ‚iddle East and —entral sia will continue to grow but at a lower rate than beore… n ”atin merica‰ growth is expected to be lat due to contraction in ¦ra§il and ¨ene§uela‰ and slower growth in rgentina… n —EE‰ nonŽlie premiums are expected to decline urther due to contraction in ˜ussia‰ where the economy remains stuc in recession… ¢verall nonŽlie sector proitability will NonŽlie insurers’ proitability is expected to continue to be under pressure as remain subdued… investment returns remain depressed and sot maret conditions continue… Swiss Re sigma No 3/2016 1

World Insurance in 2015 Page 20 Page 22

World Insurance in 2015 Page 20 Page 22