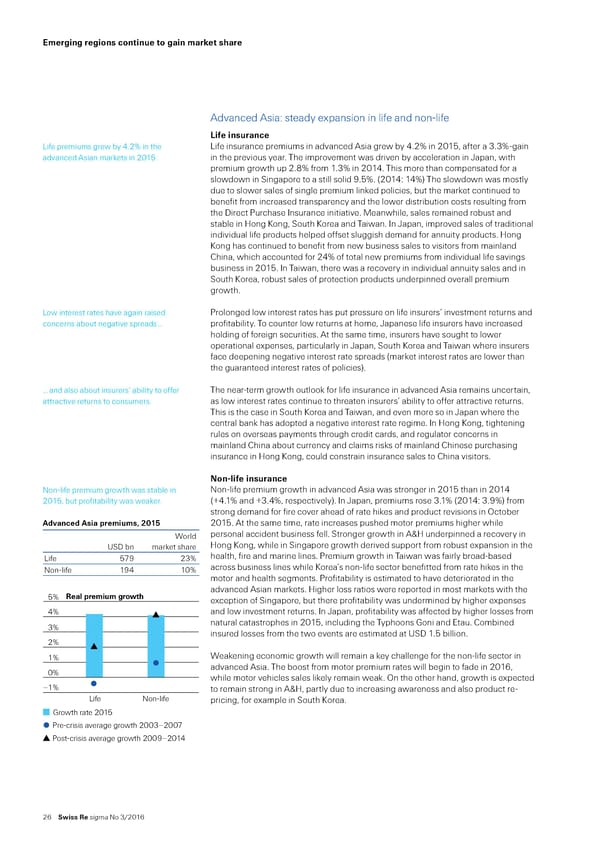

erging regions continue to gain ar„et s‚are dvanced sia“ steady expansion in lie and nonŽlie Life insurance ”ie premiums grew by ’…2ˆ in the ”ie insurance premiums in advanced sia grew by ’…2ˆ in 201‰ ater a 3…3ˆŽgain advanced sian marets in 201… in the previous year… The improvement was driven by acceleration in •apan‰ with premium growth up 2…ˆ rom 1…3ˆ in 201’… This more than compensated or a slowdown in „ingapore to a still solid ¡…ˆ… †201’“ 1’ˆ‡ The slowdown was mostly due to slower sales o single premium lined policies‰ but the maret continued to beneit rom increased transparency and the lower distribution costs resulting rom the irect €urchase nsurance initiative… ‚eanwhile‰ sales remained robust and stable in ‘ong –ong‰ „outh –orea and Taiwan… n •apan‰ improved sales o traditional individual lie products helped oset sluggish demand or annuity products… ‘ong –ong has continued to beneit rom new business sales to visitors rom mainland —hina‰ which accounted or 2’ˆ o total new premiums rom individual lie savings business in 201… n Taiwan‰ there was a recovery in individual annuity sales and in „outh –orea‰ robust sales o protection products underpinned overall premium growth… ”ow interest rates have again raised €rolonged low interest rates has put pressure on lie insurers’ investment returns and concerns about negative spreads … proitability… To counter low returns at home‰ •apanese lie insurers have increased holding o oreign securities… t the same time‰ insurers have sought to lower operational expenses‰ particularly in •apan‰ „outh –orea and Taiwan where insurers ace deepening negative interest rate spreads †maret interest rates are lower than the guaranteed interest rates o policies‡… … and also about insurers’ ability to oer The nearŽterm growth outloo or lie insurance in advanced sia remains uncertain‰ attractive returns to consumers… as low interest rates continue to threaten insurers’ ability to oer attractive returns… This is the case in „outh –orea and Taiwan‰ and even more so in •apan where the central ban has adopted a negative interest rate regime… n ‘ong –ong‰ tightening rules on overseas payments through credit cards‰ and regulator concerns in mainland —hina about currency and claims riss o mainland —hinese purchasing insurance in ‘ong –ong‰ could constrain insurance sales to —hina visitors… Non-life insurance NonŽlie premium growth was stable in NonŽlie premium growth in advanced sia was stronger in 201 than in 201’ 201‰ but proitability was weaer… †£’…1ˆ and £3…’ˆ‰ respectively‡… n •apan‰ premiums rose 3…1ˆ †201’“ 3…¡ˆ‡ rom strong demand or ire cover ahead o rate hies and product revisions in ¢ctober ’d anced ’sia ‡reius• 2015 201… t the same time‰ rate increases pushed motor premiums higher while Œorld personal accident business ell… „tronger growth in ™‘ underpinned a recovery in ‹„ bn maret share ‘ong –ong‰ while in „ingapore growth derived support rom robust expansion in the ”ie ƒ¡ 23ˆ health‰ ire and marine lines… €remium growth in Taiwan was airly broadŽbased NonŽlie 1¡’ 10ˆ across business lines while –orea’s nonŽlie sector beneitted rom rate hies in the motor and health segments… €roitability is estimated to have deteriorated in the Real premium growth advanced sian marets… ‘igher loss ratios were reported in most marets with the 5% exception o „ingapore‰ but there proitability was undermined by higher expenses 4% and low investment returns… n •apan‰ proitability was aected by higher losses rom 3% natural catastrophes in 201‰ including the Typhoons oni and Etau… —ombined insured losses rom the two events are estimated at ‹„ 1… billion… 2% 1% Œeaening economic growth will remain a ey challenge or the nonŽlie sector in 0% advanced sia… The boost rom motor premium rates will begin to ade in 2016‰ while motor vehicles sales liely remain wea… ¢n the other hand‰ growth is expected –1% to remain strong in ™‘‰ partly due to increasing awareness and also product reŽ LifeNon-life pricing‰ or example in „outh –orea… Growth rate 2015 Pre-crisis average growth 2003–2007 Post-crisis average growth 2009–2014 26 Swiss Re sigma No 3/2016

World Insurance in 2015 Page 33 Page 35

World Insurance in 2015 Page 33 Page 35