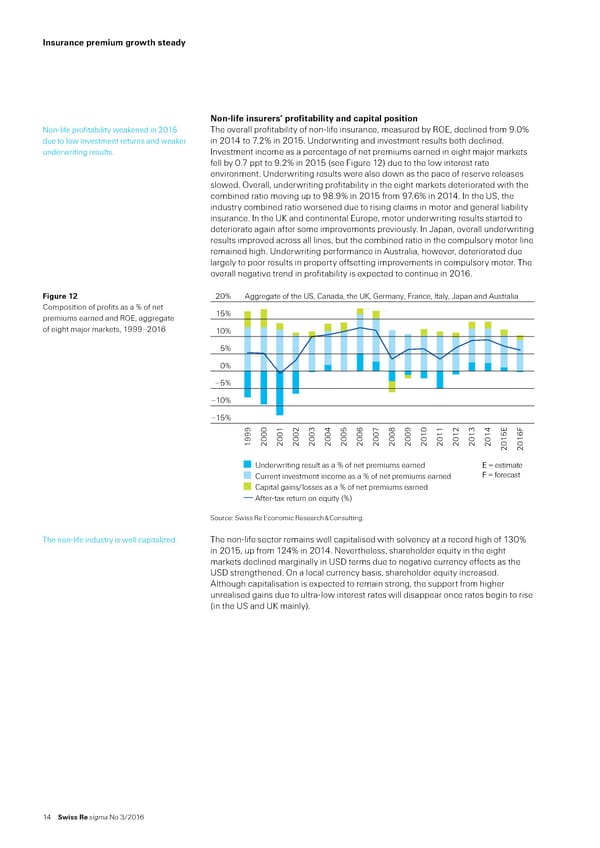

‰nsurance ‡reiu growt‚ stead€ Non-life insurers’ ‡rofitaƒilit€ and ca‡ital ‡osition NonŽlie proitability weaened in 201 The overall proitability o nonŽlie insurance‰ measured by ˜¢E‰ declined rom ¡…0ˆ due to low investment returns and weaer in 201’ to ƒ…2ˆ in 201… ‹nderwriting and investment results both declined… underwriting results… nvestment income as a percentage o net premiums earned in eight maŠor marets ell by 0…ƒ ppt to ¡…2ˆ in 201 †see ¥igure 12‡ due to the low interest rate environment… ‹nderwriting results were also down as the pace o reserve releases slowed… ¢verall‰ underwriting proitability in the eight marets deteriorated with the combined ratio moving up to ¡…¡ˆ in 201 rom ¡ƒ…6ˆ in 201’… n the ‹„‰ the industry combined ratio worsened due to rising claims in motor and general liability insurance… n the ‹– and continental Europe‰ motor underwriting results started to deteriorate again ater some improvements previously… n •apan‰ overall underwriting results improved across all lines‰ but the combined ratio in the compulsory motor line remained high… ‹nderwriting perormance in ustralia‰ however‰ deteriorated due largely to poor results in property osetting improvements in compulsory motor… The overall negative trend in proitability is expected to continue in 2016… Figure 12 0% Aggregate of the US, Canada, the UK, Germany, France, Italy, Japan and Atrala —omposition o proits as a ˆ o net 15% premiums earned and ˜¢E‰ aggregate o eight maŠor marets‰ 1¡¡¡–2016 10% 5% 0% –5% –10% –15% 1 000 001 0000 00 00500 00€ 00‚ 00010 011 01 0101 015ƒ01F Under‹rtng relt a a % of net premm earned E = estimate Crrent nŠetment ncome a a % of net premm earned F = forecast Captal gan‰loe a a % of net premm earned After„ta… retrn on e†ty ‡%ˆ „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… The nonŽlie industry is well capitali§ed… The nonŽlie sector remains well capitalised with solvency at a record high o 130ˆ in 201‰ up rom 12’ˆ in 201’… Nevertheless‰ shareholder e«uity in the eight marets declined marginally in ‹„ terms due to negative currency eects as the ‹„ strengthened… ¢n a local currency basis‰ shareholder e«uity increased… lthough capitalisation is expected to remain strong‰ the support rom higher unrealised gains due to ultraŽlow interest rates will disappear once rates begin to rise †in the ‹„ and ‹– mainly‡… 1’ Swiss Re sigma No 3/2016

World Insurance in 2015 Page 19 Page 21

World Insurance in 2015 Page 19 Page 21