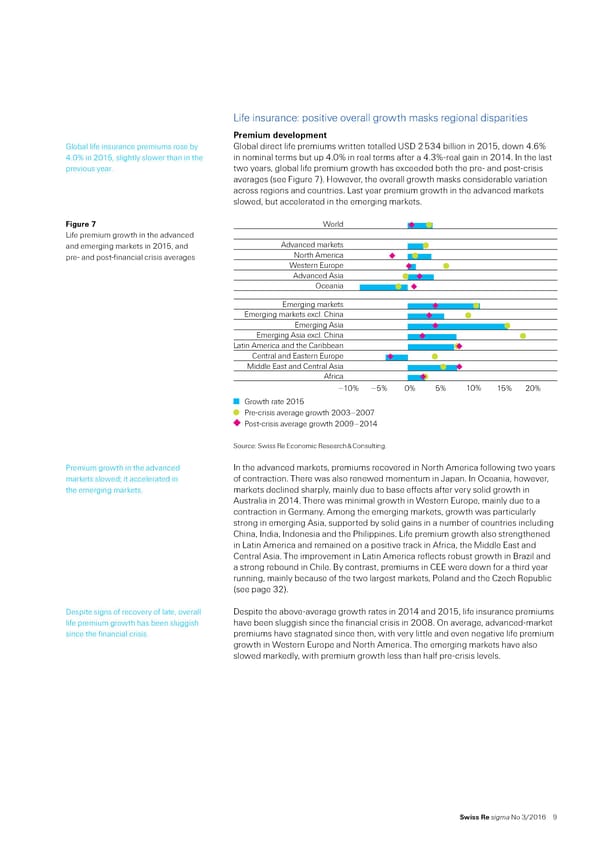

”ie insurance“ positive overall growth mass regional disparities †reiu de elo‡ent lobal lie insurance premiums rose by lobal direct lie premiums written totalled ‹„ 2 3’ billion in 201‰ down ’…6ˆ ’…0ˆ in 201‰ slightly slower than in the in nominal terms but up ’…0ˆ in real terms ater a ’…3ˆŽreal gain in 201’… n the last previous year… two years‰ global lie premium growth has exceeded both the preŽ and postŽcrisis averages †see ¥igure ƒ‡… ‘owever‰ the overall growth mass considerable variation across regions and countries… ”ast year premium growth in the advanced marets slowed‰ but accelerated in the emerging marets… Figure ˆ World ”ie premium growth in the advanced and emerging marets in 201‰ and Advanced markets preŽ and postŽinancial crisis averages North America Western Europe Advanced Asia Oceania Emerging markets Emerging markets excl. China Emerging Asia Emerging Asia excl. China Latin America and the Caribbean Central and Eastern Europe Middle East and Central Asia A…rica † „† † „† † „† † ƒroth rate „ Precrisis average groth €‚ Postcrisis average groth „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… €remium growth in the advanced n the advanced marets‰ premiums recovered in North merica ollowing two years marets slowedŸ it accelerated in o contraction… There was also renewed momentum in •apan… n ¢ceania‰ however‰ the emerging marets… marets declined sharply‰ mainly due to base eects ater very solid growth in ustralia in 201’… There was minimal growth in Œestern Europe‰ mainly due to a contraction in ermany… mong the emerging marets‰ growth was particularly strong in emerging sia‰ supported by solid gains in a number o countries including —hina‰ ndia‰ ndonesia and the €hilippines… ”ie premium growth also strengthened in ”atin merica and remained on a positive trac in rica‰ the ‚iddle East and —entral sia… The improvement in ”atin merica relects robust growth in ¦ra§il and a strong rebound in —hile… ¦y contrast‰ premiums in —EE were down or a third year running‰ mainly because o the two largest marets‰ €oland and the —§ech ˜epublic †see page 32‡… espite signs o recovery o late‰ overall espite the aboveŽaverage growth rates in 201’ and 201‰ lie insurance premiums lie premium growth has been sluggish have been sluggish since the inancial crisis in 200… ¢n average‰ advancedŽmaret since the inancial crisis… premiums have stagnated since then‰ with very little and even negative lie premium growth in Œestern Europe and North merica… The emerging marets have also slowed maredly‰ with premium growth less than hal preŽcrisis levels… Swiss Re sigma No 3/2016 ¡

World Insurance in 2015 Page 14 Page 16

World Insurance in 2015 Page 14 Page 16