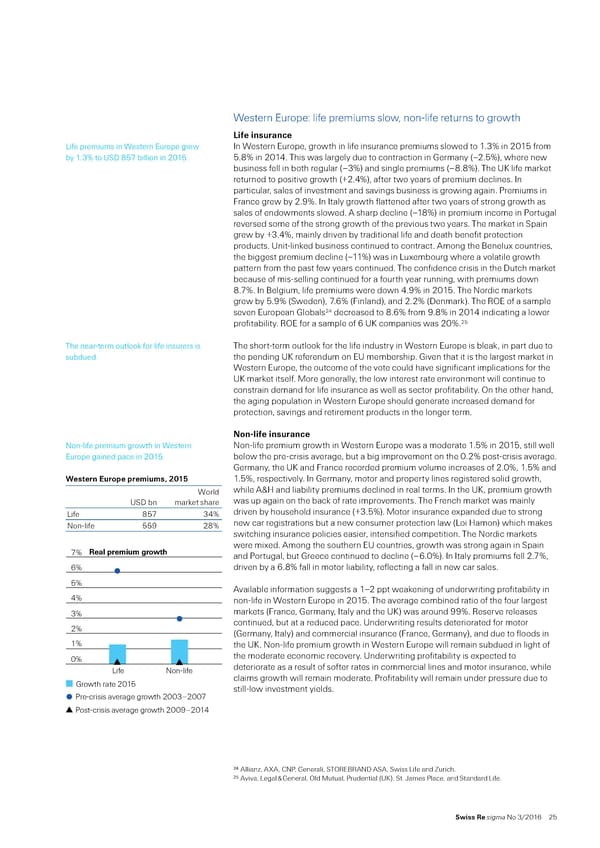

Œestern Europe“ lie premiums slow‰ nonŽlie returns to growth Life insurance ”ie premiums in Œestern Europe grew n Œestern Europe‰ growth in lie insurance premiums slowed to 1…3ˆ in 201 rom by 1…3ˆ to ‹„ ƒ billion in 201… …ˆ in 201’… This was largely due to contraction in ermany †–2…ˆ‡‰ where new business ell in both regular †–3ˆ‡ and single premiums †–…ˆ‡… The ‹– lie maret returned to positive growth †£2…’ˆ‡‰ ater two years o premium declines… n particular‰ sales o investment and savings business is growing again… €remiums in ¥rance grew by 2…¡ˆ… n taly growth lattened ater two years o strong growth as sales o endowments slowed… sharp decline †–1ˆ‡ in premium income in €ortugal reversed some o the strong growth o the previous two years… The maret in „pain grew by £3…’ˆ‰ mainly driven by traditional lie and death beneit protection products… ‹nitŽlined business continued to contract… mong the ¦enelux countries‰ the biggest premium decline †–11ˆ‡ was in ”uxembourg where a volatile growth pattern rom the past ew years continued… The conidence crisis in the utch maret because o misŽselling continued or a ourth year running‰ with premiums down …ƒˆ… n ¦elgium‰ lie premiums were down ’…¡ˆ in 201… The Nordic marets grew by …¡ˆ †„weden‡‰ ƒ…6ˆ †¥inland‡‰ and 2…2ˆ †enmar‡… The ˜¢E o a sample seven European lobals2’ decreased to …6ˆ rom ¡…ˆ in 201’ indicating a lower proitability… ˜¢E or a sample o 6 ‹– companies was 20ˆ…2 The nearŽterm outloo or lie insurers is The shortŽterm outloo or the lie industry in Œestern Europe is blea‰ in part due to subdued… the pending ‹– reerendum on E‹ membership… iven that it is the largest maret in Œestern Europe‰ the outcome o the vote could have signiicant implications or the ‹– maret itsel… ‚ore generally‰ the low interest rate environment will continue to constrain demand or lie insurance as well as sector proitability… ¢n the other hand‰ the aging population in Œestern Europe should generate increased demand or protection‰ savings and retirement products in the longer term… Non-life insurance NonŽlie premium growth in Œestern NonŽlie premium growth in Œestern Europe was a moderate 1…ˆ in 201‰ still well Europe gained pace in 201… below the preŽcrisis average‰ but a big improvement on the 0…2ˆ postŽcrisis average… ermany‰ the ‹– and ¥rance recorded premium volume increases o 2…0ˆ‰ 1…ˆ and Western uro‡e ‡reius• 2015 1…ˆ‰ respectively… n ermany‰ motor and property lines registered solid growth‰ Œorld while ™‘ and liability premiums declined in real terms… n the ‹–‰ premium growth ‹„ bn maret share was up again on the bac o rate improvements… The ¥rench maret was mainly ”ie ƒ 3’ˆ driven by household insurance †£3…ˆ‡… ‚otor insurance expanded due to strong NonŽlie ¡ 2ˆ new car registrations but a new consumer protection law †”oi ‘amon‡ which maes switching insurance policies easier‰ intensiied competition… The Nordic marets Real premium growth were mixed… mong the southern E‹ countries‰ growth was strong again in „pain 7% and €ortugal‰ but reece continued to decline †–6…0ˆ‡… n taly premiums ell 2…ƒˆ‰ % driven by a 6…ˆ all in motor liability‰ relecting a all in new car sales… 5% vailable inormation suggests a 1–2 ppt weaening o underwriting proitability in 4% nonŽlie in Œestern Europe in 201… The average combined ratio o the our largest 3% marets †¥rance‰ ermany‰ taly and the ‹–‡ was around ¡¡ˆ… ˜eserve releases 2% continued‰ but at a reduced pace… ‹nderwriting results deteriorated or motor †ermany‰ taly‡ and commercial insurance †¥rance‰ ermany‡‰ and due to loods in 1% the ‹–… NonŽlie premium growth in Œestern Europe will remain subdued in light o 0% the moderate economic recovery… ‹nderwriting proitability is expected to LifeNon-life deteriorate as a result o soter rates in commercial lines and motor insurance‰ while Growth rate 2015 claims growth will remain moderate… €roitability will remain under pressure due to stillŽlow investment yields… Pre-crisis average growth 2003–2007 Post-crisis average growth 2009–2014 24 llian§‰ ® ‰ —N€‰ enerali‰ „T¢˜E¦˜ N „ ‰ „wiss ”ie and ¹urich… 25 viva‰ ”egal ™ eneral‰ ¢ld ‚utual‰ €rudential †‹–‡‰ „t… •ames €lace‰ and „tandard ”ie… Swiss Re sigma No 3/2016 2

World Insurance in 2015 Page 32 Page 34

World Insurance in 2015 Page 32 Page 34