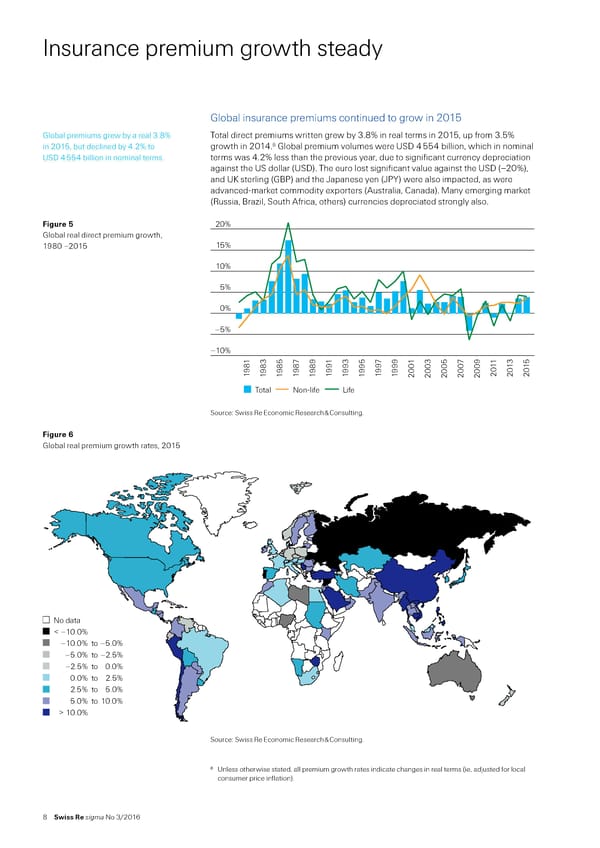

nsurance premium growth steady lobal insurance premiums continued to grow in 201 lobal premiums grew by a real 3…ˆ Total direct premiums written grew by 3…ˆ in real terms in 201‰ up rom 3…ˆ 6 in 201‰ but declined by ’…2ˆ to growth in 201’… lobal premium volumes were ‹„ ’ ’ billion‰ which in nominal ‹„ ’ ’ billion in nominal terms… terms was ’…2ˆ less than the previous year‰ due to signiicant currency depreciation against the ‹„ dollar †‹„‡… The euro lost signiicant value against the ‹„ †–20ˆ‡‰ and ‹– sterling †¦€‡ and the •apanese yen †•€µ‡ were also impacted‰ as were advancedŽmaret commodity exporters † ustralia‰ —anada‡… ‚any emerging maret †˜ussia‰ ¦ra§il‰ „outh rica‰ others‡ currencies depreciated strongly also… Figure 5 20% lobal real direct premium growth‰ 1¡0 –201 15% 10% 5% 0% –5% –10% 1 3 5 7 9 1 3 5 7 3 5 9 11 13 15 8 8 8 8 8 9 9 9 9 999 01 0 0 07 0 0 0 0 19 19 19 19 19 19 19 19 19 1 0 0 2 2 2 2 20 20 2 20 Total Non-life Life „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… Figure lobal real premium growth rates‰ 201 No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… 6 ‹nless otherwise stated‰ all premium growth rates indicate changes in real terms †ie‰ adŠusted or local consumer price inlation‡… Swiss Re sigma No 3/2016

World Insurance in 2015 Page 13 Page 15

World Insurance in 2015 Page 13 Page 15