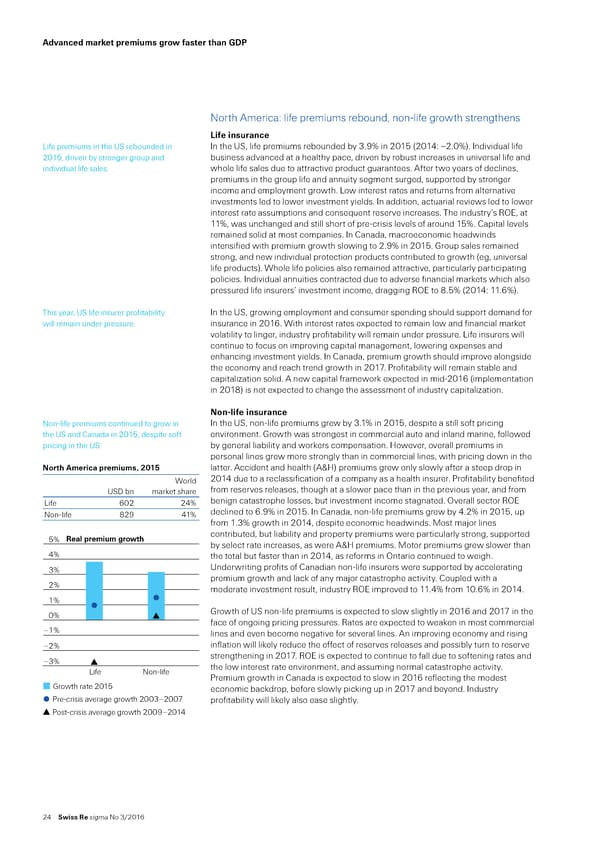

’d anced ar„et ‡reius grow faster t‚an Ž“† North merica“ lie premiums rebound‰ nonŽlie growth strengthens Life insurance ”ie premiums in the ‹„ rebounded in n the ‹„‰ lie premiums rebounded by 3…¡ˆ in 201 †201’“ –2…0ˆ‡… ndividual lie 201‰ driven by stronger group and business advanced at a healthy pace‰ driven by robust increases in universal lie and individual lie sales… whole lie sales due to attractive product guarantees… ter two years o declines‰ premiums in the group lie and annuity segment surged‰ supported by stronger income and employment growth… ”ow interest rates and returns rom alternative investments led to lower investment yields… n addition‰ actuarial reviews led to lower interest rate assumptions and conse«uent reserve increases… The industry’s ˜¢E‰ at 11ˆ‰ was unchanged and still short o preŽcrisis levels o around 1ˆ… —apital levels remained solid at most companies… n —anada‰ macroeconomic headwinds intensiied with premium growth slowing to 2…¡ˆ in 201… roup sales remained strong‰ and new individual protection products contributed to growth †eg‰ universal lie products‡… Œhole lie policies also remained attractive‰ particularly participating policies… ndividual annuities contracted due to adverse inancial marets which also pressured lie insurers’ investment income‰ dragging ˜¢E to …ˆ †201’“ 11…6ˆ‡… This year‰ ‹„ lie insurer proitability n the ‹„‰ growing employment and consumer spending should support demand or will remain under pressure… insurance in 2016… Œith interest rates expected to remain low and inancial maret volatility to linger‰ industry proitability will remain under pressure… ”ie insurers will continue to ocus on improving capital management‰ lowering expenses and enhancing investment yields… n —anada‰ premium growth should improve alongside the economy and reach trend growth in 201ƒ… €roitability will remain stable and capitali§ation solid… new capital ramewor expected in midŽ2016 †implementation in 201‡ is not expected to change the assessment o industry capitali§ation… Non-life insurance NonŽlie premiums continued to grow in n the ‹„‰ nonŽlie premiums grew by 3…1ˆ in 201‰ despite a still sot pricing the ‹„ and —anada in 201‰ despite sot environment… rowth was strongest in commercial auto and inland marine‰ ollowed pricing in the ‹„… by general liability and worers compensation… ‘owever‰ overall premiums in personal lines grew more strongly than in commercial lines‰ with pricing down in the Nort‚ ’erica ‡reius• 2015 latter… ccident and health † ™‘‡ premiums grew only slowly ater a steep drop in Œorld 201’ due to a reclassiication o a company as a health insurer… €roitability beneited ‹„ bn maret share rom reserves releases‰ though at a slower pace than in the previous year‰ and rom ”ie 602 2’ˆ benign catastrophe losses‰ but investment income stagnated… ¢verall sector ˜¢E NonŽlie 2¡ ’1ˆ declined to 6…¡ˆ in 201… n —anada‰ nonŽlie premiums grew by ’…2ˆ in 201‰ up rom 1…3ˆ growth in 201’‰ despite economic headwinds… ‚ost maŠor lines 5% Real premium growth contributed‰ but liability and property premiums were particularly strong‰ supported by select rate increases‰ as were ™‘ premiums… ‚otor premiums grew slower than 4% the total but aster than in 201’‰ as reorms in ¢ntario continued to weigh… 3% ‹nderwriting proits o —anadian nonŽlie insurers were supported by accelerating 2% premium growth and lac o any maŠor catastrophe activity… —oupled with a moderate investment result‰ industry ˜¢E improved to 11…’ˆ rom 10…6ˆ in 201’… 1% 0% rowth o ‹„ nonŽlie premiums is expected to slow slightly in 2016 and 201ƒ in the ace o ongoing pricing pressures… ˜ates are expected to weaen in most commercial –1% lines and even become negative or several lines… n improving economy and rising –2% inlation will liely reduce the eect o reserves releases and possibly turn to reserve –3% strengthening in 201ƒ… ˜¢E is expected to continue to all due to sotening rates and LifeNon-life the low interest rate environment‰ and assuming normal catastrophe activity… €remium growth in —anada is expected to slow in 2016 relecting the modest Growth rate 2015 economic bacdrop‰ beore slowly picing up in 201ƒ and beyond… ndustry Pre-crisis average growth 2003–2007 proitability will liely also ease slightly… Post-crisis average growth 2009–2014 2’ Swiss Re sigma No 3/2016

World Insurance in 2015 Page 31 Page 33

World Insurance in 2015 Page 31 Page 33