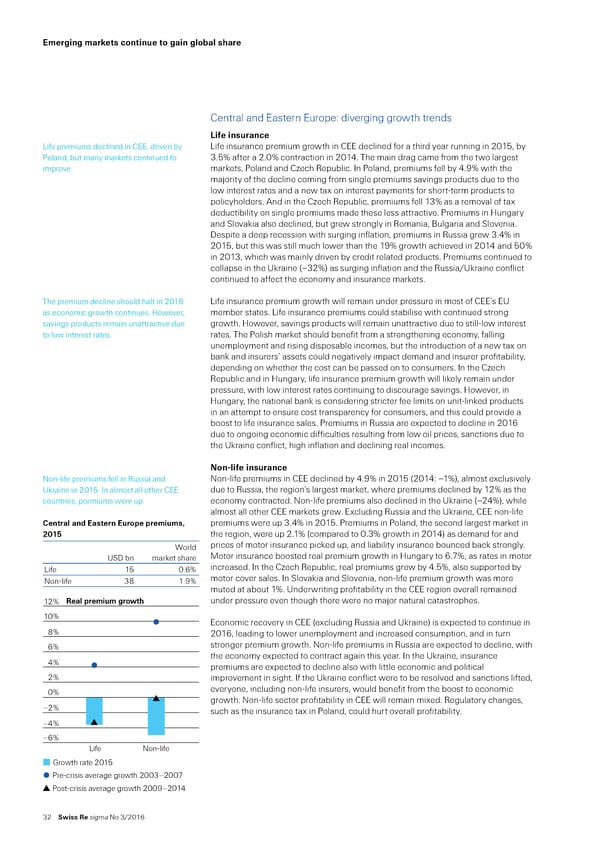

erging ar„ets continue to gain gloƒal s‚are —entral and Eastern Europe“ diverging growth trends Life insurance ”ie premiums declined in —EE‰ driven by ”ie insurance premium growth in —EE declined or a third year running in 201‰ by €oland‰ but many marets continued to 3…ˆ ater a 2…0ˆ contraction in 201’… The main drag came rom the two largest improve… marets‰ €oland and —§ech ˜epublic… n €oland‰ premiums ell by ’…¡ˆ with the maŠority o the decline coming rom single premiums savings products due to the low interest rates and a new tax on interest payments or shortŽterm products to policyholders… nd in the —§ech ˜epublic‰ premiums ell 13ˆ as a removal o tax deductibility on single premiums made these less attractive… €remiums in ‘ungary and „lovaia also declined‰ but grew strongly in ˜omania‰ ¦ulgaria and „lovenia… espite a deep recession with surging inlation‰ premiums in ˜ussia grew 3…’ˆ in 201‰ but this was still much lower than the 1¡ˆ growth achieved in 201’ and 0ˆ in 2013‰ which was mainly driven by credit related products… €remiums continued to collapse in the ‹raine †–32ˆ‡ as surging inlation and the ˜ussia/‹raine conlict continued to aect the economy and insurance marets… The premium decline should halt in 2016 ”ie insurance premium growth will remain under pressure in most o —EE’s E‹ as economic growth continues… ‘owever‰ member states… ”ie insurance premiums could stabilise with continued strong savings products remain unattractive due growth… ‘owever‰ savings products will remain unattractive due to stillŽlow interest to low interest rates… rates… The €olish maret should beneit rom a strengthening economy‰ alling unemployment and rising disposable incomes‰ but the introduction o a new tax on ban and insurers’ assets could negatively impact demand and insurer proitability‰ depending on whether the cost can be passed on to consumers… n the —§ech ˜epublic and in ‘ungary‰ lie insurance premium growth will liely remain under pressure‰ with low interest rates continuing to discourage savings… ‘owever‰ in ‘ungary‰ the national ban is considering stricter ee limits on unitŽlined products in an attempt to ensure cost transparency or consumers‰ and this could provide a boost to lie insurance sales… €remiums in ˜ussia are expected to decline in 2016 due to ongoing economic diiculties resulting rom low oil prices‰ sanctions due to the ‹raine conlict‰ high inlation and declining real incomes… Non-life insurance NonŽlie premiums ell in ˜ussia and NonŽlie premiums in —EE declined by ’…¡ˆ in 201 †201’“ –1ˆ‡‰ almost exclusively ‹raine in 201… n almost all other —EE due to ˜ussia‰ the region’s largest maret‰ where premiums declined by 12ˆ as the countries‰ premiums were up… economy contracted… NonŽlie premiums also declined in the ‹raine †–2’ˆ‡‰ while almost all other —EE marets grew… Excluding ˜ussia and the ‹raine‰ —EE nonŽlie Œentral and astern uro‡e ‡reius• premiums were up 3…’ˆ in 201… €remiums in €oland‰ the second largest maret in 2015 the region‰ were up 2…1ˆ †compared to 0…3ˆ growth in 201’‡ as demand or and Œorld prices o motor insurance piced up‰ and liability insurance bounced bac strongly… ‹„ bn maret share ‚otor insurance boosted real premium growth in ‘ungary to 6…ƒˆ‰ as rates in motor ”ie 1 0…6ˆ increased… n the —§ech ˜epublic‰ real premiums grew by ’…ˆ‰ also supported by NonŽlie 3 1…¡ˆ motor cover sales… n „lovaia and „lovenia‰ nonŽlie premium growth was more muted at about 1ˆ… ‹nderwriting proitability in the —EE region overall remained 12% Real premium growth under pressure even though there were no maŠor natural catastrophes… 10% Economic recovery in —EE †excluding ˜ussia and ‹raine‡ is expected to continue in 8% 2016‰ leading to lower unemployment and increased consumption‰ and in turn 6% stronger premium growth… NonŽlie premiums in ˜ussia are expected to decline‰ with 4% the economy expected to contract again this year… n the ‹raine‰ insurance premiums are expected to decline also with little economic and political 2% improvement in sight… the ‹raine conlict were to be resolved and sanctions lited‰ 0% everyone‰ including nonŽlie insurers‰ would beneit rom the boost to economic growth… NonŽlie sector proitability in —EE will remain mixed… ˜egulatory changes‰ –2% such as the insurance tax in €oland‰ could hurt overall proitability… –4% –6% LifeNon-life Growth rate 2015 Pre-crisis average growth 2003–200 Post-crisis average growth 200–2014 32 Swiss Re sigma No 3/2016

World Insurance in 2015 Page 40 Page 42

World Insurance in 2015 Page 40 Page 42