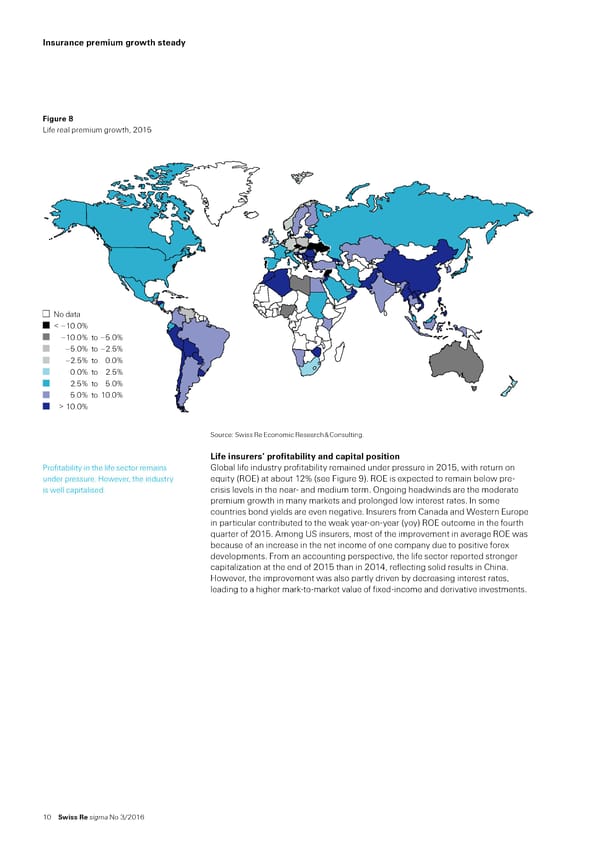

Insurance premium growth steady Figure 8 •ie real remium growth 201 No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% Source: Swiss Re Economic Research & Consulting. Life insurers’ profitability and capital position –roitailit in the lie sector remains Gloal lie inustr roitailit remaine uner ressure in 201 with return on uner ressure. ”owe‰er the inustr euit €R‚Eƒ at aout 12„ €see …igure †ƒ. R‚E is e‡ecte to remain elow reˆ is well caitalise. crisis le‰els in the nearˆ an meium term. ‚ngoing heawins are the moerate remium growth in man marŠets an rolonge low interest rates. ‹n some countries on iels are e‰en negati‰e. ‹nsurers rom Canaa an Œestern Euroe in articular contriute to the weaŠ earˆonˆear €oƒ R‚E outcome in the ourth uarter o 201. Žmong ‘S insurers most o the imro‰ement in a‰erage R‚E was ecause o an increase in the net income o one coman ue to ositi‰e ore‡ e‰eloments. …rom an accounting ersecti‰e the lie sector reorte stronger caitali’ation at the en o 201 than in 201“ relecting soli results in China. ”owe‰er the imro‰ement was also artl ri‰en ecreasing interest rates leaing to a higher marŠˆtoˆmarŠet ‰alue o i‡eˆincome an eri‰ati‰e in‰estments. 10 Swiss Re sigma No 3/2016

World Insurance in 2015 Page 15 Page 17

World Insurance in 2015 Page 15 Page 17