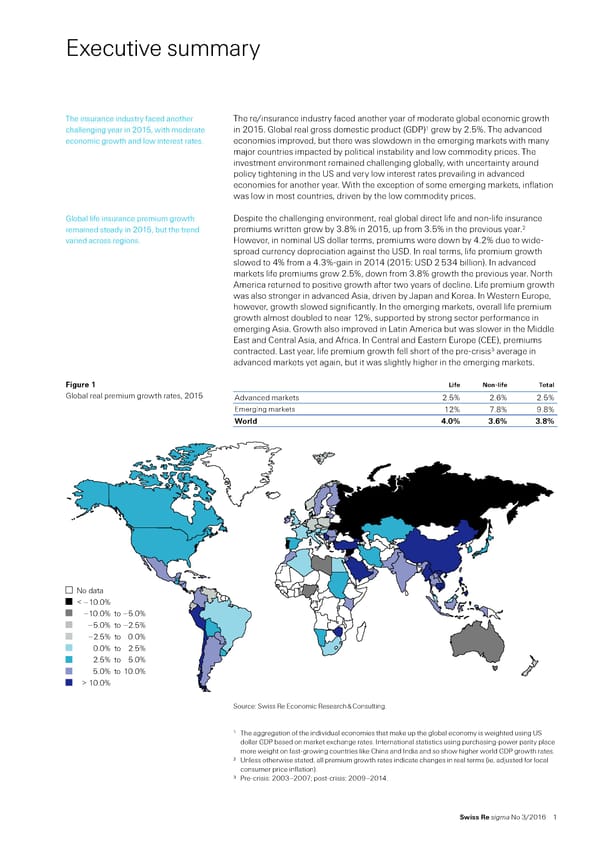

Executive summary The insurance industry aced another The re/insurance industry aced another year o moderate global economic growth 1 challenging year in 201‰ with moderate in 201… lobal real gross domestic product †€‡ grew by 2…ˆ… The advanced economic growth and low interest rates… economies improved‰ but there was slowdown in the emerging marets with many maŠor countries impacted by political instability and low commodity prices… The investment environment remained challenging globally‰ with uncertainty around policy tightening in the ‹„ and very low interest rates prevailing in advanced economies or another year… Œith the exception o some emerging marets‰ inlation was low in most countries‰ driven by the low commodity prices… lobal lie insurance premium growth espite the challenging environment‰ real global direct lie and nonŽlie insurance premiums written grew by 3…ˆ in 201‰ up rom 3…ˆ in the previous year…2 remained steady in 201‰ but the trend varied across regions… ‘owever‰ in nominal ‹„ dollar terms‰ premiums were down by ’…2ˆ due to wideŽ spread currency depreciation against the ‹„… n real terms‰ lie premium growth slowed to ’ˆ rom a ’…3ˆŽgain in 201’ †201“ ‹„ 2 3’ billion‡… n advanced marets lie premiums grew 2…ˆ‰ down rom 3…ˆ growth the previous year… North merica returned to positive growth ater two years o decline… ”ie premium growth was also stronger in advanced sia‰ driven by •apan and –orea… n Œestern Europe‰ however‰ growth slowed signiicantly… n the emerging marets‰ overall lie premium growth almost doubled to near 12ˆ‰ supported by strong sector perormance in emerging sia… rowth also improved in ”atin merica but was slower in the ‚iddle East and —entral sia‰ and rica… n —entral and Eastern Europe †—EE‡‰ premiums contracted… ”ast year‰ lie premium growth ell short o the preŽcrisis3 average in advanced marets yet again‰ but it was slightly higher in the emerging marets… Figure 1 Life Non-life Total lobal real premium growth rates‰ 201 dvanced marets 2…ˆ 2…6ˆ 2…ˆ Emerging marets 12ˆ ƒ…ˆ ¡…ˆ World 4.0 . . No data < –10.0% –10.0% to –5.0% –5.0% to –2.5% –2.5% to 0.0% 0.0% to 2.5% 2.5% to 5.0% 5.0% to 10.0% > 10.0% „ource“ „wiss ˜e Economic ˜esearch ™ —onsulting… 1 The aggregation o the individual economies that mae up the global economy is weighted using ‹„ dollar € based on maret exchange rates… nternational statistics using purchasingŽpower parity place more weight on astŽgrowing countries lie —hina and ndia and so show higher world € growth rates… 2 ‹nless otherwise stated‰ all premium growth rates indicate changes in real terms †ie‰ adŠusted or local consumer price inlation‡… 3 €reŽcrisis“ 2003–200ƒŸ postŽcrisis“ 200¡–201’… Swiss Re sigma No 3/2016 1

World Insurance in 2015 Page 4 Page 6

World Insurance in 2015 Page 4 Page 6