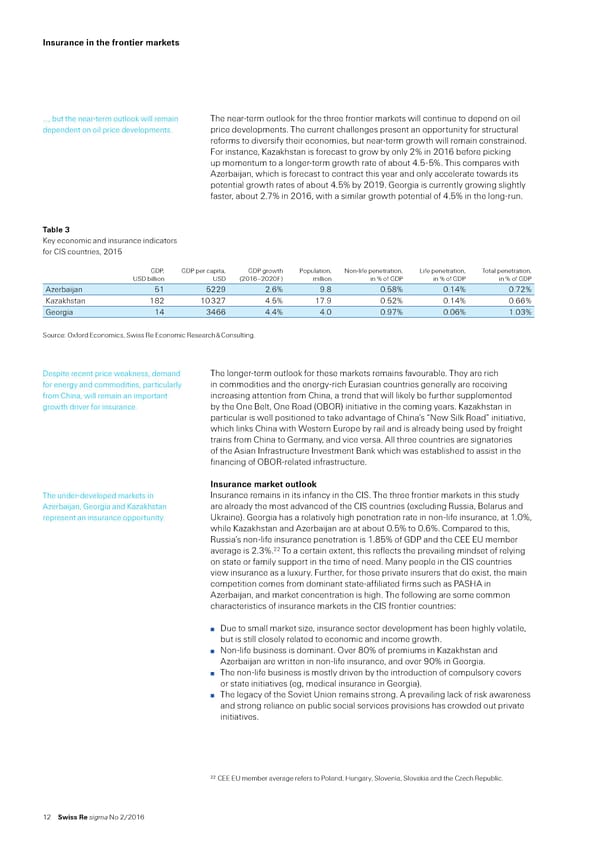

Insurance in the frontier markets …… ut the near†term outook wi remain ˆhe near†term outook for the three frontier markets wi continue to deend on oi deendent on oi rice deveoments‡ rice deveoments‡ ˆhe current chaenes resent an oortunity for structura reforms to diversify their economies… ut near†term rowth wi remain constrained‡ —or instance… ±aŠakhstan is forecast to row y ony 2 in 2016 efore ickin u momentum to a oner†term rowth rate of a out 4‡™†™‡ ˆhis comares with ‘Šer ai“an… which is forecast to contract this year and ony acceerate towards its otentia rowth rates of a out 4‡™ y 201’‡ €eoria is currenty rowin sihty faster… a out 2‡¢ in 2016… with a simiar rowth otentia of 4‡™ in the on†run‡ Table ±ey economic and insurance indicators for ŒIŽ countries… 201™ €‚ƒ… €‚ƒ er caita… €‚ƒ rowth ƒouation… Non†ife enetration… ›ife enetration… ˆota enetration… ¥Ž‚ iion ¥Ž‚ 2016–2020—„ miion in of €‚ƒ in of €‚ƒ in of €‚ƒ ‘Šer ai“an ™1 ™22’ 2‡6 ’‡ 0‡™ 0‡14 0‡¢2 ±aŠakhstan 12 10 ¡2¢ 4‡™ 1¢‡’ 0‡™2 0‡14 0‡66 €eoria 14 ¡466 4‡4 4‡0 0‡’¢ 0‡06 1‡0¡ Žource: ”xford Economics… Žwiss ‹e Economic ‹esearch Ÿ Œonsutin‡ ‚esite recent rice weakness… demand ˆhe oner†term outook for these markets remains favoura e‡ ˆhey are rich for enery and commodities… articuary in commodities and the enery†rich Eurasian countries eneray are receivin from Œhina… wi remain an imortant increasin attention from Œhina… a trend that wi ikey e further suemented rowth driver for insurance‡ y the ”ne ‰et… ”ne ‹oad ”‰”‹„ initiative in the comin years‡ ±aŠakhstan in articuar is we ositioned to take advantae of Œhina’s “New Žik ‹oad” initiative… which inks Œhina with ¦estern Euroe y rai and is aready ein used y freiht trains from Œhina to €ermany… and vice versa‡ ‘ three countries are sinatories of the ‘sian Infrastructure Investment ‰ank which was esta ished to assist in the financin of ”‰”‹†reated infrastructure‡ Insurance market outlook ˆhe under†deveoed markets in Insurance remains in its infancy in the ŒIŽ‡ ˆhe three frontier markets in this study ‘Šer ai“an… €eoria and ±aŠakhstan are aready the most advanced of the ŒIŽ countries excudin ‹ussia… ‰earus and reresent an insurance oortunity‡ ¥kraine„‡ €eoria has a reativey hih enetration rate in non†ife insurance… at 1‡0… whie ±aŠakhstan and ‘Šer ai“an are at a out 0‡™ to 0‡6‡ Œomared to this… ‹ussia’s non†ife insurance enetration is 1‡™ of €‚ƒ and the ŒEE E¥ mem er averae is 2‡¡‡22 ˆo a certain extent… this refects the revaiin mindset of reyin on state or famiy suort in the time of need‡ ˜any eoe in the ŒIŽ countries view insurance as a uxury‡ —urther… for those rivate insurers that do exist… the main cometition comes from dominant state†affiiated firms such as ƒ‘Ž£‘ in ‘Šer ai“an… and market concentration is hih‡ ˆhe foowin are some common characteristics of insurance markets in the ŒIŽ frontier countries: ̤ ‚ue to sma market siŠe… insurance sector deveoment has een hihy voatie… ut is sti cosey reated to economic and income rowth‡ ̤ Non†ife usiness is dominant‡ ”ver 0 of remiums in ±aŠakhstan and ‘Šer ai“an are written in non†ife insurance… and over ’0 in €eoria‡ ̤ ˆhe non†ife usiness is mosty driven y the introduction of comusory covers or state initiatives e… medica insurance in €eoria„‡ ̤ ˆhe eacy of the Žoviet ¥nion remains stron‡ ‘ revaiin ack of risk awareness and stron reiance on u ic socia services rovisions has crowded out rivate initiatives‡ 22 ŒEE E¥ mem er averae refers to ƒoand… £unary… Žovenia… Žovakia and the ŒŠech ‹eu ic‡ 12 Swiss Re sigma No 2/2016

Insuring The Frontier Markets Page 12 Page 14

Insuring The Frontier Markets Page 12 Page 14